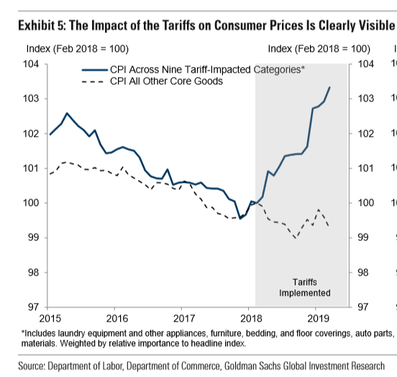

Anyone that is paying even half-hearted attention to the news today will know that stock markets here fell. A lot. News agencies are likely to use words like “melted down” or “tumbled” and they won’t be far off the mark. The key question is likely to be “what the devil happened?!” After all, it was less than a week ago that the Federal Reserve cut their interest rates by 0.25% in an effort to spur investing and keep the growth story going. Should they have cut more? Why did we fall out of bed today? There are several key reasons and they are all interrelated. We can boil them all down to one key idea – China trade. As you know, the Trump administration has been working towards a new Chinese trade deal seemingly from the first day. China has committed some bad acts – stealing our intellectual property by forcing any U.S. tech company that wants to do business in China to have a Chinese partner firm, for example. U.S. tech companies lined up to do this with eyes wide open just to gain access to their 1.4 billion consumers. This does not mean it was fair or right. It wasn’t and practices like that needed to be addressed. We had apparently been having “productive” negotiations with China. A trade delegation returned from Shanghai on Tuesday and this was the report from the White House. Then on Thursday, President Trump tweeted that beginning on September 1, there will be a new round of 10% tariffs on the $300 billion of Chinese goods not already being taxed. The current tariffs that are in place were on what we call industrial and intermediate goods. Basically, the tariffs affected products used in production. This does not mean that we consumers did not pay these tariffs. It simply means they were more hidden. In fact, here is a chart from the U.S. Department of Labor that shows the effects of the tariffs to date. The blue line represents the change in prices for all goods that are being taxed while the dotted line represents the prices of all other goods. The shaded area represents the time the tariffs have been in place. As you can clearly see, shortly after the tariffs hit, the prices for all goods being taxed soared while the prices for all other goods has remained relatively stable. This directly contradicts the message coming out of this White House that there has been no noticeable affect of these tariffs and that China is absorbing the costs. Those are obviously false statements. The next round of tariffs this administration wants to impose starting on September 1 will more directly impact consumers. These tariffs will hit companies like Nike and Apple, for example. It is estimated that over 60% of the products affected in this upcoming round of tariffs are consumer goods such as apparel and footwear, toys and cellphones. This means the consumer – you and me – are about to be hit more directly in our pocketbooks. Now the tariffs are bad enough, but the bigger issue seems to be that this round of tariffs is signaling that a trade deal is all but off the table. You don’t have productive talks and then implement punishing tariffs. China, of course, has retaliated for this new slap in their face. The Chinese government has instructed their state-owned entities not to purchase any U.S. agricultural products. In 2017, we exported about $19.6 billion in agricultural products to China. I think it is safe to say that we will be lucky to ship a fraction of that this year. This has had a devastating impact on small American farmers. The USDA (Department of Agriculture) has tried to help these small farmers with $16 billion in aid. Basically, the USDA is paying out welfare to these farmers who have no markets for their crops. Just under a week ago, the White House said that based on those “constructive” talks, China was committed “to increase purchases of United States Agricultural exports.” In addition to banning further purchases, China did something rather extraordinary today. China allowed the exchange rate for their currency to slip below a key and significant level. Without getting too far into the weeds, what this essentially does is make Chinese exports cheaper leading to other countries buying Chinese goods that we do not or cannot purchase. President Trump is very likely to hike the tariffs to 25% to retaliate for the retaliation. We are essentially in an all-out trade war now, and there does not seem to be any hope for a deal on the horizon. At this point I believe President Trump was correct when he said the Chinese were going to wait for the elections in the hopes of getting a new administration to negotiate with. What is the outlook going forward? There are several things that I think will happen. First is that with higher costs on goods we import from China – and we will keep importing these goods from China because we cannot shift manufacturing overnight to another country or back to the U.S. – this will likely result in lower consumer spending. Second is that we are very likely to get more Fed interest rate cuts, but these won’t do anything to help the situation. Why? The biggest issue right now domestically is a lack of investment by businesses. By “investment” I don’t mean buying stocks and bonds but investing in new plants and equipment. Business spending has essentially ground to a halt. The Trump administration claimed the tax cuts would spur more business spending. Tax policy has never influenced business investment. Businesses make investment decisions based on how much of a return they can earn. Interest rates influence this far more than tax policy. And, while lower interest rates can entice businesses to invest more in plants and equipment, what businesses really want is clarity. With the world a very uncertain place right now and the trade war heating up instead of winding down businesses are looking for ways to protect themselves, not take chances on new ventures. Third, with decreased business investment, this is likely to lead to stagnant earnings at best and more likely lower earnings down the road. This is likely to result in something called “P/E compression”. Basically, investors are willing to pay a certain amount for a year’s worth of a stock’s earnings. For example, if a company earns $2 per share for the year and the stock sells for $20 per share, this is P/E ratio of 10. Typically speaking, the broad market will sell for a P/E ratio around 15 – 18 times earnings per share. That is, if the earnings for the market is $100, then a P/E ratio of 18 would imply a price of 1,800 for the S&P 500 Index. As of the end of July, based on what companies in the index had earned for the twelve months, the P/E ratio on the index was about 21 times earnings. This is on the high end of things but not outrageous. However, if investors decide that, given weaker global economies and slower growth, they were not willing to pay more than 15 times earnings, this would lead to the S&P 500 Index falling to around 2130, assuming earnings don’t change. This would be a loss of over 28% for the index! I do not expect this dramatic of a correction, and this type of a correction is not likely to happen suddenly, but I do expect investors to pay less for earnings than they have been paying recently. Fourth, I think the odds of a recession have dramatically increased. We are not there yet, but we certainly seem to be pointed in that direction. If that is the case we will want to scale back on stocks going in to the recession and load up on bonds in anticipation of the interest rate cuts. When interest rates fall, bond prices tend to rise driving up the value of bonds you own. Anticipating and being ready to act will help steer us through this mess. What did we do in the face of this turmoil today? Basically, nothing. Actually, that is not quite true. We did make one change in portfolios. We have been using the PIMCO Income fund as our “go to” bond fund. This fund has a very admirable track record but, frankly I have been worried about it in client accounts. This fund has taken some risks to achieve their returns and that has worried me. So today we moved most of our holdings in the PIMCO Income fund over to the Janus Henderson Multi-Sector Income fund (JMUTX). This fund also has an admirable track record, lower fees, is smaller and more nimble and has less risk than the PIMCO fund. In addition to this change I have been investigating an idea to take advantage of the trade war. Businesses want clarity and they want to outsource manufacturing to cheaper labor. China had provided that but that is not an option currently. Businesses are starting to look at other countries in the region as a substitute. My suspicion is that Vietnam will be a beneficiary of this trade war, so I am likely to add an investment in a fund that invests in the Vietnamese market. I will probably dip our toe in the water initially and add to it over time if it begins to pan out. Additionally, I will be gradually shifting some funds from stocks to bonds if we continue along the current trajectory. There will be a time when we will want to start buying stocks again, but this is not necessarily that time. As always, if you have any questions for me or need anything, please feel free to call me! Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com

0 Comments

Leave a Reply. |

Contact us

|

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed