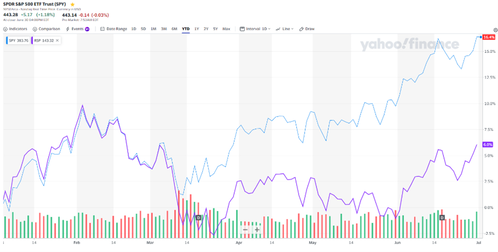

So far, this year is unfolding in much the way that I thought it might from an economic standpoint. However, from an investment standpoint, I admit to being confused. Investors are seemingly making some irrational decisions considering where the economy stands. Let’s review a bit. The Fed continued to raise interest rates, but just as I predicted, they only raised once during the quarter and only by one-quarter of a percent. This put the effective Fed funds interest rate at 5.125%, which was higher than the current rate of inflation. Speaking of inflation, this continued to trend down, having fallen from its high just over 9% last June to the current reading of 4.05% as of the beginning of June. We won’t have the read on the June level of inflation until early July. However, it is widely expected to remain around that 4% level. Fed Chairman Jay Powell has been adamant that he wants to bring the inflation rate back down to around 2% annually and has suggested that more rate hikes may be needed to achieve this goal. This likely means two more rate hikes this year of probably 0.25% each if the Federal Reserve goes through with this plan. The key reason Fed Chair Powell as well as other Federal Reserve Board members have intimated more rate hikes is the resiliency within the economy. Unemployment remains low at around 3.7% though the number of individuals filing for unemployment claims has ticked up a little bit in the past two months. Lower unemployment typically means a stronger economy and that often translates into sticky prices. In other words, if unemployment remains low, the inflation rate is likely to remain stuck around that 4% level, which is too high for the Fed. In addition, while it has been trending down, consumer spending is still reasonably strong, especially on such items as dining out and travel as well as new home purchases. From a psychological perspective, it seems that people are trying to return to living again after being sequestered for the past two years due to the pandemic. With that economic backdrop, the market has somewhat surprisingly gone on a tear this year with the S&P 500 Index up almost 16% through the end of June. This is very misleading, however. This index is comprised of 500 different companies. However, they do not all carry the same weight. They are ranked based on what is known as their market capitalization – that is, the number of shares of stock outstanding multiplied by the price per share. The higher the market capitalization (or market cap), the greater the weighting in the index. At quarter-end, Apple, for example, with a market cap of just over $3 trillion (yes, with a ‘t’) accounted for about 7.6% of the index and the top ten companies accounted for just over 30% while the bottom ten companies barely made a dent at just 0.30% combined. What drove that 16% gain was largely the top eight or ten companies in the index. Apple, for example, was up nearly 50% for the year-to-date period. Many of the largest tech companies that make up the top of this index – Apple, Microsoft, NVIDIA and Meta Platforms (i.e. Facebook) – all had double digit gains with Meta more than doubling over the past six months and semiconductor chipmaker NVIDIA gaining nearly 190% on an earnings report that indicated strength in demand for their chips for artificial intelligence or AI uses. Absent these top few stocks, the rest of the market was a bit more muted. One way to see this is in the disparity between two funds that measure the same set of companies but measure them differently. This chart shows the gains for the year for the S&P 500 index (light blue) as it is measured by market cap weightings versus a fund that invests in the same companies but equal weights them (purple line). The cap weighted S&P is up 16%, of course, while the equal weight version of this index is only up about 6% for the year-to-date period. In fact, one index of mid-sized company stocks, the S&P MidCap 400 Index is up just over 8% through the end of June and the S&P Small Cap 600 Index is up just over 5% for the period. This speaks to the fact that many stocks are still lagging while investors seem to be fleeing to the safety of the largest and seemingly techiest companies during this period of market uncertainty. The strong returns we saw in the first half of the year did bring us out of the bear market we had been in. Just as a side note, by convention it is agreed that when the market drops 20% or more from a high, we are in a bear market. That remains the case until we have rebounded 20% off the lowest point. The stock market, as measured by the S&P 500 Index, hit its all-time high on January 3, 2022, at 4,796.56 which was just before the Fed started raising interest rates to combat high inflation. We entered bear market territory in mid-June 2022 and the market bottomed in mid-October. In early June of this year, we had rebounded just over 20% from that low point, meaning we are “officially” in a bull market now even though we are still 7% below the all-time peak. Confusing, isn’t it? While we lagged behind the 16% S&P 500 Index gains due to being a bit more cautious, we still saw solid results. Until recently, I was convinced we could see the economy slipping into a recession by late this year. With that in mind, I was avoiding high-flying stocks and positioning accounts a bit more conservatively to weather that storm. At this point, I am pushing off any potential recession until next year and, even then I anticipate that it will be short and shallow at worst. In fact, I am beginning to think we may avoid a recession completely. I am still paying attention to both the economic data and what the Fed is saying as I believe them when they say they want to bring inflation back into that into that 2% range. I will not apologize for being cautious and I will not be chasing after the stocks that we missed on the way up. I do think many of these names are a bit overvalued at this point. This does not mean they won’t continue to go up in price. Investors can remain irrational for a very long time. But that gets into a game of trying to guess when everyone wants to sell, and I am not good at that game. I will continue to seek out quality companies trading at reasonable valuations and buy and hold them. During the past quarter, we made a few changes to client portfolios. We eliminated the First Trust Merger Arbitrage ETF (ticker: MARB) with no significant gain or loss. We felt there were other opportunities that offered better risk / return rewards. We also sold out of shipping stock, Matson Inc. (ticker: MATX) with a loss. The company fundamentals had changed significantly for the worse, so we cut our losses and moved on. On the additions side, we added trucking company ArcBest Corp (ticker: ARCB) after selling several put options that obligate us to buy the shares at a set price. I will only sell options to buy these shares at a price that I think is fair and reasonable. Eventually, one of these options was exercised but our cost was reduced by the premium we collected. At quarter-end we already had an unrealized 14% gain on this stock. We also bought shares of cloud storage company Dropbox Inc. (ticker: DBX) which has appreciated 19% since our initial purchase. Lastly, we re-entered a position in the SPDR S&P Oil & Gas Exploration & Production ETF (ticker: XOP) around the end of April after having eliminated the position in early-January. We managed to get back into the position at a more favorable price than we sold them for originally. Lastly, for several clients we locked in a bit of these higher interest rates with a one-year CD that offered 5.2% interest. Unlike a CD that you buy through your bank, this one will change in value every day based on prevailing interest rates in the market. However, if we hold it to maturity (that is exactly our intention), we will get back our investment plus the 5.2% interest rate, so do not be alarmed by any day-to-day changes in market values. Speaking of options, we continued to use option trades strategically during the quarter. We sold put options that obligated us to buy shares of metal fabricator Mueller Industries (ticker: MLI) that have given us a 13% return on the amount we are risking. We wrote options to purchase shares of semiconductor equipment company Photronics Inc. (ticker: PLAB) on four different occasions that have earned us almost 9% in total since the end of January. Keep in mind that these types of returns are no guarantee of future results. I mentioned that I will not be chasing stocks or mutual funds that have appreciated over the past few months. While I do not expect a recession any time soon, I do expect stocks to pull back a bit from time to time. When we see such weakness, we are likely to add to positions we currently own or start new positions in stocks or funds we don’t own yet but have on our watch list. We likely won’t get in at the bottom unless we are just extremely lucky, but we will always look to pay a fair price for the company or fund we purchase. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com

0 Comments

|

Contact us

|

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed