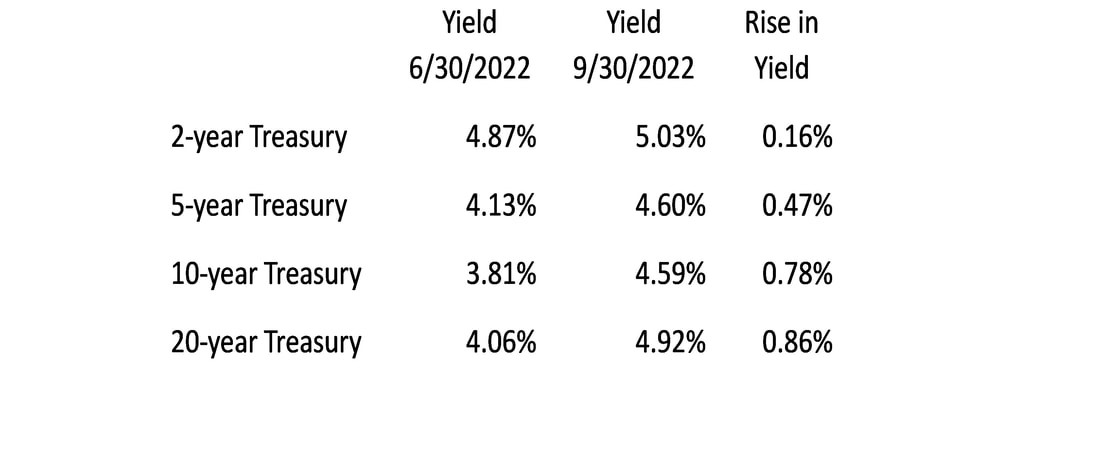

This seems to have been the quarter when investors finally started to believe what the Federal Reserve has been saying for the past year and a half. Ever since the Fed started raising interest rates in early 2022, the mantra has been “raise interest rates to the target goal to choke off inflation and keep rates at that level until the goal is met.” That clearly stated goal didn’t prevent many market pundits from predicting interest rate cuts as early as the fourth quarter of this year. What caused the shift in perspective? Simply put, economic data continued to be relatively strong. The continued solid economic numbers – from job growth to wages modestly increasing – have served to keep the pressure on the Federal Reserve in their inflation battle. While the inflation rate has dropped significantly from 9.06% in June 2022 to around 3.67% as of August, we are still not near the 2% target rate the Federal Reserve has set. As investors reassessed the big economic picture, we saw interest rates – especially longer-term interest rates – rise relatively dramatically, which caused stock prices to drop for the quarter. As you can see by the table below, interest rates moved up across the spectrum. In fact, with interest rates on Treasury bonds at highs we have not seen since 2006, we are actively looking at a few bond ideas for clients to lock in some of these higher rates. If our thesis is correct – that interest rates will remain at these elevated levels for at least the next year before we start to see any cuts in interest rates, we can earn 5 – 5.5% in interest and we may be able to see some capital gains from any individual bond or bond mutual funds we hold. These higher interest rates led to lower stock prices. The S&P 500 Index – heavily influenced by seven very large tech companies that were viewed as “safe havens” for institutional investors – fell 3.65% for the quarter. A better measure of how stocks in general fared is the equal-weight version of this index, which fell 5.45% for the quarter. The reason stock prices fell is that when investors have a choice between a higher, safer return (bonds) versus a potentially high but riskier return (stocks), they will usually choose the more certain investment option. In the current environment, when investors see a relatively sure 5% return from Treasury bonds or 6 – 8% potential return from riskier stocks with a lot more volatility, the safer return becomes the more attractive option. While stocks in general fell, not all sectors did poorly. The energy sector (oil and gas) did very well, with the S&P 500 energy sector gaining just over 12% for the quarter. The exchange-traded fund we hold across multiple client accounts, the SPDR Oil & Gas Exploration & Production ETF (ticker: XOP) gained 15.49% for the quarter. This resulted from oil rising from $70 per barrel to around $90 per barrel at the end of the quarter. Oil has pulled back a bit in price since the end of the quarter, but we continue to believe the long-term trend is for oil to remain in this price range. In part we were not very active traders this past quarter, adding only one new position in travel website company Expedia Group Inc. (ticker: EXPE). While the stock is down from our original purchase price, we still feel the company is very undervalued. We also added to our position in the VanEck Morningstar Wide Moat ETF (ticker: MOAT) several times as the price pulled back throughout the quarter. This mutual fund has been one of the best performing funds investing across large capitalization companies. This fund is now about 10% of a typical client account allocation so we are satisfied with that level of investment. Our outlook for the year ahead is the same as it always has been – believe the Federal Reserve. They have stated their intentions very clearly, and they have followed through on them. Interest rates are likely to remain around the current levels for the next few months. My one fear is that the Fed becomes too laser-focused on a 2% inflation rate. Our economy faces some structural changes – the baby boomers are retiring in droves and there are not enough workers behind them to take their places – so targeting a 2% inflation rate as we had over the past decade may not be realistic. Targeting a range of 2% - 3% inflation is probably more feasible and sustainable, but we will have to see how things evolve. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com

0 Comments

Leave a Reply. |

Contact us

|

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed