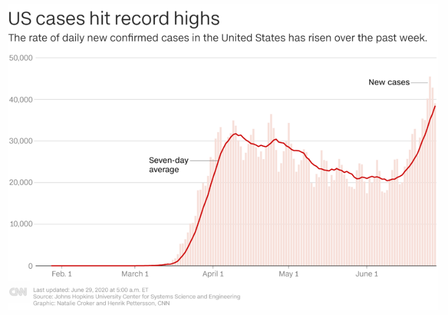

First of all, I hope this letter finds you and your family safe and sound and healthy during this pandemic. With that said, let us dive in to this past quarter. We officially entered a recession in February which ended the longest expansion on record that started in 2009, 128 months ago. This recession may turn out to be the shortest recession on record but that remains to be seen. The prior record for the shortest recession was six months back in 1980. Whether we quickly end this recession or not depends upon controlling the coronavirus. During May and June, we saw unemployment drop from 23 million in April to just over 17 million by the end of June. The official unemployment rate fell from 14.7% to 11.1%, which was somewhat of a surprise. Most of this growth came from the retail and restaurant sectors as states attempted to restart their economies. This “growth” may be transient, though, considering the ever-growing coronavirus cases across the country. As the accompanying chart shows, we were just starting to head in the right direction before quickly turning and heading in the wrong direction. This could be problematic. Many states are especially hesitant to go backwards and close their economies down to stem this rising spread of the coronavirus. They may not have a choice, though. The one thing that could allow businesses to continue to operate is if more people wore masks. However, this has become a political issue more than a social or economic issue. This should never be a political or partisan issue. All of this puts the U.S. economy in a very fragile space. Do we “damn the torpedoes, full speed ahead” with the economy and risk a much higher number of deaths or do we pause or even go backwards on the reopening of businesses in order to reduce the number of positive cases and hopefully contain the virus until a cure or vaccine is found? Add to this a President who is up for re-election and had planned to run on a strong economy until the coronavirus hit. He is now more determined than ever to get back to where we were in January and February and that could be dangerous. In the face of this conflicting data – strong unemployment numbers coupled with rising coronavirus cases throughout the U.S. – the stock market has been stellar. So far. The Fed announced major stimulus on March 23 and over the next three days, the stock market rallied for a 17.6% gain, the largest three-day advance in more than 80 years. By early-June, the market was up almost 45% above the lows of March and within 5% of the all-time high that was hit in late-February. The index gained 19.95% for the quarter. It was looking like those who predicted a “V” shaped recovery were correct. From the numbers put up by the S&P 500 Index, it would seem that things are going well. However, when you dig a little deeper into the returns of the 500 companies that make up this index, you find a slightly different story. It was really two sectors that drove this surge in the S&P 500 Index. One was technology, up 30% for the quarter. This was driven primarily by Microsoft and Apple which together make up 41% of this sector. The consumer discretionary sector also gained 30% driven largely by Amazon.com which is 23% of the sector’s weighting. This sector also did well thanks to investors buying riskier investments such as restaurants, cruise lines and home builders. One of the best examples of how crazy investors went this past quarter is probably encapsulated in the shares of Hertz stock. Hertz, the auto rental company, has about $20 billion in debt. Most of their rental business took place at airports and with air travel down 80% or more from a year ago, no one was renting vehicles. In early-May, the company requested forbearance on their debt and then on Friday, May 22 Hertz filed for bankruptcy after the close of the trading day. The stock had closed at $2.84 per share on that day. On the following Monday, the stock traded at $0.55 per share as, even by the company’s own admission, shareholders were likely to walk away with nothing in the event the company did manage to restructure. Within two weeks, speculators had driven the price of Hertz stock up from $0.55 per share to $5.53 per share on pure hope. The company continued to point out their stock was essentially worthless but nonetheless filed to sell additional shares of stock to raise an additional $500 million given the sharp spike in the stock price. This plan ultimately died but this was the risk appetite of investors this past quarter. Investors were buying regardless of the risks or prospects for companies to recover.  With this “risk on” mentality, let us dig just a little deeper into the performance of the S&P 500 Index. First, let me explain that this index is what we called “market cap weighted”. Market capitalization or market cap for short is simply a calculation of the total value of a company’s stock. You take the price of the stock at any one moment in time and multiply by the total number of shares of stock the company has sold (called “shares outstanding”) to get the market capitalization. The S&P 500 Index “weights” each company in the index by its market cap. In other words, the company with the largest market cap carries the most weight and the company with the smallest market cap has the least influence on the index’s value. Currently, the top five companies by market cap weighting are Microsoft, Apple, Amazon.com, Facebook and Alphabet (Google) with these five companies comprising 20% of the index. It is instructive to look at an equal weight index of this index in comparison. In an equal weight index, no component initially carries more weight than another. The five companies listed above currently make up 1.06% of the equal weight index. During the past quarter, the equal weight index did slightly better than the market cap weighted index. This is easily explained by investors who took on more risks buying cruise lines, airlines, and bankrupt companies which carry less weight in a market-cap weighted index. However, since the start of the year, the equal-weighted index still lags its market-cap weighted brother by a noticeable margin. The accompanying chart shows the returns of the S&P 500 index (red line) versus the equal weight S&P 500 Index (green) since the start of the year. The market cap weighted index is down 4% while the equal weight index is off by over 12% through the end of June. The outperformance of the market-cap weighted index is concentrated in the performance of a few tech names that exert far more influence. The bottom line here is that most stocks are not performing nearly as well as “the market” might make you think. With most stocks still down 12% for the year and coronavirus cases surging, I am not terribly worried about a major meltdown. You might wonder what has caused me to lose my mind like this. I assure you I am no Pollyanna, seeing unicorns and rainbows where there are none. I am very worried about states that may have tried to restart their economy too soon. I am very worried about the rapidly increasing infection rates and the potential for many businesses to have to close again and for another round of layoffs. The one thing that allows me to sleep just a little better at nights is the Federal Reserve. The Government has stepped up with over a trillion dollars in stimulus through $1,200 checks or a $600 “bonus” in unemployment pay. These measures have helped ease the economic damage caused by the coronavirus in the short run. However, the government’s response is somewhat limited and must move through both houses of Congress and the President’s desk. The Federal Reserve can act relatively quickly, and they have. They have lowered interest rates back to zero and they have stepped in to buy back bonds. This last measure is where I find comfort. The Federal Reserve has been actively buying bonds for years. Post the Great Recession, the Federal Reserve undertook a program they called “quantitative easing”. This entailed buying government bonds from the public. This put cash in the hands of investors. The hope was that investors would take this cash and invest it by starting a business or buying a piece of equipment to improve production or build another plant. Instead, this cash found its way back into the stock market. Investors bought stocks, which drove the stock market up over 500% from the lows of 2009 through the peak in mid-February. I mentioned earlier the stimulus the Fed announced in late-March that led to an almost 18% rally in stocks. Following on the heels of that announcement, the Federal Reserve has stepped with even more money. They have offered to buy not only government bonds but now they have stated a willingness to buy corporate bonds, junk bonds and even bond mutual funds in the form of ETFs or exchange traded funds. All of this serves to essentially put a “floor” underneath the markets. Does this mean that we cannot have stocks sell off? Of course not. The Federal Reserve is not going to try to stop every dip, but they have signaled a willingness to step in when things get rough. This psychological floor should help sustain stocks’ upward momentum, at least for the short term. With all of that as a backdrop, we made a few trades over the course of the quarter. We added two new stock names to client accounts. The first was Astec Industries (ticker: ASTE), a manufacturer of heavy road equipment and the other was ACCO Brands (ticker: ACCO), which makes and distributes office and school equipment (think Swingline staplers or Mead notebooks). In addition, we added two new mutual funds to client accounts. I had mentioned the Virtus KAR Midcap Growth (ticker: PHSKX) fund in my previous letter, and we did start adding that to client accounts in early April. We started purchasing shares for $37 per share and by the end of the quarter, this fund was trading for over $52 per share for a 40% gain. We also added the Putnam Growth Opportunities fund (ticker: POGAX) to client accounts as well. This fund, which currently leans heavily on technology stocks (Microsoft, Apple, Amazon.com and Alphabet account for almost a third of the fund’s holdings) was added starting in late May to client accounts. I intend to keep a close eye on this fund, as I am beginning to worry about a potential bubble in these tech stocks. We did eliminate our holding in the T. Rowe Price International Discovery (ticker: PRIDX) fund this quarter. This is a good fund for exposure to smaller, growing foreign companies but with the coronavirus situation across the globe, we felt the risk was entirely too great and the better opportunities were here in the U.S. Towards the very end of the quarter, we added options on the S&P 500 that will benefit if the value of the market falls. I know that I said earlier that I expected the Federal Reserve to “backstop” stocks to keep them from melting down too far. The options we own protect us in the event of a 10% drop from where the market closed out the quarter. Even if the Fed is willing to step in, the uncertainty surrounding the coronavirus, businesses potentially having to reclose creates too much uncertainty and the risk for a sudden, sharp drop. I consider this to be “insurance” against a short, sharp correction. These options should protect us through late-August. I had truly hoped that things would be much different with the coronavirus situation at this point. Given the increasing cases currently happening around the country, I will again forego in-person meetings with clients to help keep everyone safe. However, that does not mean we cannot meet face-to-face. I have added GoToMeeting, a video conferencing software to my repertoire. Last quarter I mentioned that I had added Zoom. Shortly after doing that, I learned of Zoom’s many flaws that allowed hackers through. Rather than risk my computer being compromised and client data being lost, I chose to delete that program and move to one that I know to be more reliable and safer. If you would like to schedule a meeting with me, please feel free to either email me or call me and I will set this up and send you the invite to the meeting. As always, we genuinely appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com

1 Comment

|

Contact us

|

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed