|

I have been reading a great book recently that touches on much of the psychology behind many of the investing decisions and errors that investors make. The book, Thinking, Fast and Slow by Nobel prize winner Danial Kahneman, is a user-friendly narrative behind his thinking and research that led to the development of the field of behavioral economics. One of the things Dr. Kahneman points out – and something I have been saying for a long time – is that we as investors are hard-wired to put a narrative to events. This is an attempt to put order to an often random and chaotic world.

We have had a volatile stock market since mid-September with any number of narratives to help explain what is going on and why investors are selling. No, buying. No, selling again. First it was Chinese real estate developer Evergrande’s potential bankruptcy. Then the Federal Reserve calmed fears by confirming what they have been saying all along – they will start tapering sooner rather than later and will follow that up with interest rate hikes. Next it was hotter than expected inflation numbers. So many headlines and so much confusion. Let us try to sort this out a bit. There are really two emotions that drive the market – fear and greed. When fear is high enough, people will sell anything and everything. Oftentimes financial advisors will talk about owning “uncorrelated assets”. The idea is to own two different investments that will move in different directions when things get rough. A simple example would be owning an airline stock and an oil company. Since one of the major costs for an airline is their fuel costs if the price of oil increases this will hurt the airline’s profitability and presumably the stock price. However, the oil company obviously benefits from this price increase as should their stock price. The stock prices should move in opposite directions when the price of oil changes. However, when fear rises, investors tend to ignore fundamentals and sell stocks indiscriminately. We often see investors selling both their airline stocks and their oil stocks at the same time. In “finance-speak” we would say that all assets have become highly correlated. The opposite effect occurs when greed is high. Investors tend to rush out and buy regardless of the outlook or underlying fundamentals. Oftentimes investors will create a narrative that justifies outrageous valuations. Sometimes investors have no other choice. This would explain the world of investing since the Great Recession. The Federal Reserve lowered interest rates to effectively zero. This was done to prod businesses to borrow money to invest in building new plants and buying new equipment to spur growth in the economy. The economy did grow but never at the rate that anyone wanted nor expected though this should not have been a surprise. Of course, one side effect of low interest rates is that people who rely on earning interest on their investments effectively earn nothing. This forces investors to seek returns elsewhere. The only alternative has been to invest in stocks for growth and dividends and growth is what investors got. Since the 2009 post-Recession low, we have seen the stock market pull back on a few occasions. There were often external forces or headlines at work, but the reality is that investors were just more fearful. The first instance was in 2011 when Greece faced a debt crisis with the threat of bankruptcy and investors feared another 2008-like debt crisis. This was also the first time the U.S. balked on raising the debt ceiling and credit rating agencies downgraded U.S. Government debt from an almost risk-free AAA bond rating to AA+ debt rating. As a side note, as I write this, we are currently facing this very cliff again. We again faced down fear in late-2015 through early-2016 when China’s growth rate was slowing, and oil prices were falling. This proved to be a short-lived “crisis” as greed again soon took over and by March we were back to where we started. Fear was stoked again in the fourth quarter of 2018 as we were embroiled in a damaging trade war with China and the Jerome Powell-led Fed raised interest rates for a fourth time for the year and indicated more was to come the following year. Just a few days into January 2019, Powell was speaking to the American Economic Association and walked back the interest rate hike just a month earlier and indicated he was inclined to cut rates rather than raise them again. Fear was erased, and greed took over again. Lastly, there was, of course, the 35% losses sustained in March 2020 when the COVID-19 pandemic shut our economy down completely but by July all losses had been completely recouped as fear of an extended economic shutdown disappeared, replaced by hope life could return to normal sooner rather than later. While the stories that have been spun during these corrections have all been different, the outcomes have been the same. Fear in the short-term drives markets down until greed takes over and we are quickly at previous levels and higher. There may also be a hint of “FOMO” – fear of missing out on gains. In our current economic environment with very low interest rates, we remain in a “TINA” world – there is no alternative. Investors who want any kind of return are forced to take higher levels of risk than might otherwise be prudent in a more normal world. This is likely to remain the case until the Fed raises interest rates significantly. Since the end of the Great Recession, investors have always been rewarded for “buying the dips”. After one of the more recent pullbacks, I was chatting with a client about his worries over the markets. He mentioned to me conversations he had recently with his son who actively trades options. His son, my client told me, had urged his father to sell everything and “go to cash” until the market bottomed. “That’s perfect!” I replied. “And just when will the market bottom?” His son had apparently not given him any figure for how far down he expected the market to tumble. Our fear leads us to think that every time the market starts to tumble that it is different this time and the start of the financial apocalypse. At some point, greed kicks in, we are afraid of missing out on future gains, we convince ourselves that stocks are ‘cheap’ again and markets correct themselves. What could raise the fear factor for investors enough to make a difference? The biggest boogey monster currently is inflation. The inflation rate is measured by what is known as the consumer price index or CPI. The CPI measures the change in the price of a basket of goods and services typically used by a normal household. The CPI is measured on a year-over-year basis. Since we are now comparing prices this year to the same time last year when we were just emerging from the pandemic economic shutdown, you can imagine that prices have climbed dramatically as we return to a more normalized setting. The inflation rate has been running “hot” as the economists say, with the CPI growing at an annualized rate of 5.4% per year. This is the highest level since around 1990. There are two questions about the current level of inflation. The first question is how real this rate is and the second is how long this higher inflation rate last. There is some question about how realistic this current inflation rate is given that we are essentially comparing apples to oranges. Of course inflation is higher this year. Everything was shut down most of last year. Oil, for example, is a component of the CPI and comparing the October 2021 price of oil to the October 2020 price of oil, the price is up almost 87% year over year. If you go back a year and compare the current price of oil to the same period in 2019, however, the current price is up about 39% over the same 2019 period. While that is a jump, it is not as significant a jump. Personally I think inflation is higher than the Fed would like but lower than what the CPI indicates. As for the question about how long this higher inflation could last, that question is a bit trickier. Part of the reason for the higher inflation rate is the increased costs to businesses as shelves are restocked. We have a supply chain issue, and this is driving both the inflation rate and the potential length of time for inflation to remain elevated. When the pandemic hit, businesses around the world shut their doors to slow or halt the spread of the virus. This led to empty store shelves as people panicked and bought a year’s supply of toilet paper and soup. Most goods are now manufactured overseas, largely in China. Now, as manufacturers attempt to increase production to get things back to normal, they are running into a shortage of enough workers to run the lines. Assuming the goods get made and out the door, there can be a delay loading containers on the ships for export. Once the ships arrive in the U.S., there is a backup of ships waiting to dock to unload and even if they get to dock, there is a lack of people to unload the ships. Once unloaded, the goods are shipped out via railroad to be later transferred to trucks to be hauled to the stores. Railyards are backed up with containers to be unloaded from trains and put on a trailer. There is a lack of trailers and even if we had enough trailers, there is a lack of truck drivers. All along the way, costs are added by shippers to cover these additional costs. There is also a shortage of the materials used in production. Auto manufacturers, for example, cannot get the microchips they need to build cars, forcing them to idle some assembly lines. This has led to a shortage of new cars which drove up the prices for used cars as well as the cost for car rentals. Businesses are having to pay higher wages to find workers for everything from the manufacturing line to the cash registers all of which will translate into higher costs. Businesses will either have to accept lower profits or raise prices leading to contributing to the inflation picture. Most economists thought the blip in inflation this year would be a relatively short-lived phenomenon. Many, including Fed Chair Jay Powell, are now saying this higher inflation rate could last longer than first anticipated. Some economists are arguing higher inflation is here to stay based on the increasing wages and unfilled jobs. A few economists are evoking a blast from the ‘70’s – stagflation. Stagflation is an economy in which growth is low or stagnant and prices are increasing at high rates. Frankly, I am not worried about this scenario but just the very thought of the potential for stagflation to return raises a certain fear level among some investors. The more likely scenario is one in which the inflation rate continues at a relatively high level above the Federal Reserve’s target rate. Chairman Powell has always maintained that he thinks an inflation rate of 2% per year is reasonable and healthy but he is willing to let the inflation rate “run hot” – that is to have an inflation rate above the 2% per year level – for a short span of time. His view is that the rate should moderate over time. The danger is that inflation runs hotter for longer. If that were to happen, the Federal Reserve would want to reign this in. The chief method the Federal Reserve uses to control high inflation is to raise interest rates. This scenario of higher inflation for longer should be the biggest fear for investors. If inflation does continue at this hot pace, the Federal Reserve will be forced to raise interest rates both sooner and faster than they have intended or indicated. As interest rates increase, this does two things. First, it increases costs for businesses. Second, it begins to create investment alternatives to stocks that may be more attractive. If an investor is asked to choose between a stock paying a 2.5% dividend or a bond that matures in ten years paying 1.5% interest per year, the stock wins. If I have the choice of a bond that is paying 3.5%, interest per year now I have a tougher choice. Ultimately, many investors will abandon the volatility and risk of stocks for the relative safety of bonds, and this will drive the price of stocks down. This is a scenario that I am paying close attention to for client portfolios. Across all client accounts, most of the mutual funds we own have been focused on “growth” stocks. This has served us well as these are the stocks that have benefitted the most from this current environment. These will also be the stocks that may suffer should this environment change. Let me be clear. I am not expecting an imminent or immediate meltdown in stock prices. I do think we could see the S&P 500 Index eventually retreat from their current levels. If the Fed is raising rates, this retreat would last longer. With this expectation in mind, you will see me gradually cut back on our exposure to these growth mutual funds and reallocate to investments that are better positioned to weather the storm and continue to grow. This past quarter, we made a few changes across client accounts. We sold off our holdings in homebuilder Lennar Corp. as valuations of some homebuilders are starting to get a bit stretched. We also sold our holdings in food distributor SpartanNash, earning just over 6% return in about four months. On the flip side, we bought shares in medical products and imaging supplier Hologic, Inc. (NASD: HOLX), diagnostics and testing company Quest Diagnostics Inc. (NYSE: DGX), regional supermarket chain Ingles Markets Inc. (NASD: IMKTA), and timberland REIT (real estate investment trust) PotlatchDeltic Corp. (NASD: PCH) which comes with a 3% dividend yield. We were able to find more bargains during this more volatile quarter. We also continued to make extensive use of options to enhance our returns – either by selling call options that obligate us to sell a stock in exchange for a premium or by selling a put option that obligated us to buy the underlying stock at the stated price. Both strategies served us well during the quarter. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com

0 Comments

The operating watchword for this past quarter was “inflation”. We were preparing to hear from the Federal government on their measure of inflation and the only question was “how high”. Prices have been steadily increasing as we slowly return to a more normal post-pandemic economy. Everyone knew inflation for the first quarter of this year would be high. After all, we were comparing current prices to the first quarter of last year when the economy was shut down. We were comparing apples to oranges.

The inflation rate for April came in a 4.2% and then rose to 5.0% for May, significantly above the 2.6% rate for March and the 1.2% average for all of 2020. When the quarter started, the interest rate on a 10-year U.S. Treasury bond was 1.746% which was significantly above its pandemic low of a 0.538% interest rate. This interest rate reflected investors’ fears that inflation was imminent, and the Fed might raise interest rates to combat this problem. The key question argued between economists and investors was whether this high inflation rate was real and sustainable or, in the words of most economists “transitory”. Federal Reserve Chairman Jay Powell is in the latter camp, which has led him to not react to these high inflation numbers. Let me explain. During a recession, no one is spending any money. There is no incentive to spend now as prices are likely to fall tomorrow making the goods or services you want cheaper. To spur spending, the Federal Reserve would lower interest rates. The chief idea would be for businesses to see a low enough interest rate to incentivize them to borrow money to buy land, build new plants, buy new equipment, and hire more workers to “jump start” the economy. This has been one of the main tactics during the past two recessions – the 2008 housing bubble and the recent pandemic economic shutdown. The Federal Reserve lowered interest rates to basically zero on the shortest-term loans to drive investment. It has not worked exactly as planned, but that is another story. On the flip side, when there is inflation in an economy, prices are rising, often rapidly. When inflation exists, the incentive is to spend money now before it loses its value. Inflation also drives people to borrow money now to buy big ticket items now (houses, cars, appliances) before their prices are out of reach. If things get out of control, we have what is called hyperinflation. The poster child for this phenomenon was Germany post World War I. There are several stories out of this time about how quickly prices could change, even over lunch. There is the story of a student at Freiburg University who ordered a cup of coffee at a café. The price on the menu was 5,000 Marks. He had two cups. When the bill came, it was for 14,000 Marks. He was told that if he wanted to save money and have two cups of coffee, he should have ordered them at the same time (from Paper Money by “Adam Smith”). To stop inflation, the Federal Reserve would raise interest rates charged to banks, forcing banks to raise interest rates they charge their borrowers. If interest rates reach a high enough point, it will “choke off” this borrowing and sanity will be restored to the economy. For anyone that lived through the high inflation of the late-1970’s and early 1980’s, the fear of high inflation is very real. Let me be clear here. I do not expect a return to those inflationary rates. That was largely caused by the oil supply shock which dramatically and unexpectedly increased the price of oil very quickly. This sent shockwaves through our economy which was largely built on using oil for everything from gas-guzzling cars to plastics. And, to the point that I made earlier, this bout of inflation was finally reigned in when Fed Chairman Paul Volker dramatically raised interest rates and within three years brought inflation from over 13.5% down to around 3% annually. Circling back to the question at hand, are we facing increasing inflation or is it just transitory as many economists and the Federal Reserve seem to think. Frankly, I believe that it is transitory. We are already seeing the prices of many commodities that had soared in value coming back down to earth again. We need only look to the futures markets to see this. For example, lumber traded as low as $282.10 per 1,000 board feet in early-April 2020 during the pandemic, climbed as high as $1,733.50 in mid-May this year before falling back to $737.40 at the end of June. We have seen similar moves in corn, wheat, copper, and most other commodities as well. All these commodities are well off their recent highs set in mid-May. If this is truly indicative of transitory inflation, the Fed is correct not to raise interest rates now as that could potentially choke off the recovery from the pandemic. In fact, the Federal Reserve, in their most recent meeting, indicated they would most likely not be raising interest rates until 2023. I am cautious on this expectation and would not be surprised to see a late-2022 rate hike. I believe data may force them to move sooner than they want but, regardless, we still have at least a year of continued low interest rates fueling continued money flows into the stock market. The key reason for this, as I have been saying for a while, is that this is a TINA world – as in ‘there is no alternative’ to stocks if you want to earn any return at all. All this fascination with inflation led to an interesting rotation in stocks for the quarter. Many stocks that have been beneficiaries of the re-opening of the economy such as the airlines fell the hardest. Stocks that gained for the quarter were heavily tilted to oil companies and industrial names, both of which tend to benefit from inflationary pressures. I suspect the staying power of these oil and basic industrial stocks is as transitory as commodity prices have been. Trying to time the markets by picking and choosing the ‘hot’ sector is a fool’s errand and something we avoid. I prefer to find stocks that meet strict criteria and stick with them provided they continue to meet our standards for growth, quality, and potential long-term returns. We did a lot more trading this quarter than we normally like to do but most trades worked out in our favor. During the quarter, we sold out of Beazer Homes USA (ticker: BZH) for a 23.73% gain, eliminated Cardinal Health, Inc. (ticker: CAH) with a small 4.17% gain, sold sporting goods retailer Hibbett, Inc. (ticker: HIBB) for a 53% gain, exited boating retailer MarineMax, Inc. (ticker: HZO) with a 60% profit and closed our position in construction firm Primoris Services Corp (ticker: PRIM) with a small 13% loss. We sold either because the quality of the company had slipped in their recent earnings report, they were trading well above our estimate of a fair price, or their growth prospects were falling. On the flip side, we put some profits back to work, adding to our existing holdings in Atlas Air Worldwide (ticker: AAWW) as well as several new positions. These new holdings include paper products company Clearwater Paper Corp. (ticker: CLW), two home décor stores, At Home Group (ticker: HOME) and Williams-Sonoma Inc. (ticker: WSM), apparel retailer Citi Trends, Inc. (ticker: CTRN) and RV dealer Camping World Holdings, Inc. (ticker: CWH). We also recognized that we had too much idle cash just sitting around collecting dust in many accounts. Rather than let that continue to sit idle earning 0.01%, we bought an exchange-trade fund, the SPDR Bloomberg Barclays Investment Grade Floating Rate ETF (ticker: FLRN) that invests in short-term corporate bonds that have adjustable interest rates. This will be beneficial when interest rates do finally start going up as the interest rates paid on these bonds will also increase resulting in higher dividend yields on this fund. In the interim, the fund is paying a dividend of 0.21% on a “cash-like” investment. It is important to note that this is not a guaranteed investment, and the value can and will change. Typically speaking, the price of this fund will remain reasonably stable over the short-term. This is not an investment in which we are looking for large capital gains. We were looking for an investment that is reasonably safe, liquid, and earning something more than leaving the money in cash. This fund fit that bill well. One last point on the cash management front. One additional tool we have been using up until recently has been an options strategy called a “bull put spread” in client accounts. This has often offered us a 10 – 11% return on the amount we were risking over the course of a month. Basically, we were acting as an insurance company for people who thought the market might fall. They might purchase insurance on their portfolios in the form of put options that would pay them cash if the market fell below a certain level. We took the other side of that trade but to offset our risk, we would purchase insurance ourselves just a little bit lower in value. For example, with the S&P 500 Index trading around 4,369, we might sell an option that obligates us to pay the holder if the index fell in value to 3,995 at expiration. To offset this risk, we would turn around and purchase an option that would pay us if the index fell to 3,990, limiting our risk to the $5 difference between these two values or $500 in total. To further mitigate risk, I typically limit the number of option contracts to only 1% of any individual’s account size, though some clients can afford to take a bit more risk. This ensures that, even in the event of a market blowup, we won’t lose more than we can easily recover in a short time. This strategy typically added over 2% or more to account performance over the first half of this year in those account where we have actively traded. The key reason we have stopped doing this for now is that, with the complacency that seems to have settled over the markets, we cannot get enough premium to make this strategy worthwhile for now. I am sure this will change again in time, and we will return to this strategy. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com What a difference a year makes! This time last year, we were at the bottom of a long slide down though we didn’t know we had bottomed at that point. Things looked pretty bleak, with millions out of work and businesses closed or closing. Today we are in an entirely different place. Vaccines are rolling out at a furious pace and over 51 million people have been fully vaccinated according to the most recent CDC data. The most recent jobs report rose by over 900,000 which was well beyond expectations. Job growth was strongest in leisure and hospitality, showing the “re-opening” trade is still very much alive and well. The S&P 500 Index, a popular measure of the stock market, closed near its all time high and the first day of the second quarter closed above the 4,000 level for the first time ever. The Federal Reserve is vowing to maintain interest rates at near zero levels and continues to pump about $120 billion into the economy each month. Add to that the $1.9 trillion stimulus package Congress passed and the pending $1.2 trillion in infrastructure spending that is being negotiated and the economy is awash in money seeking investments.

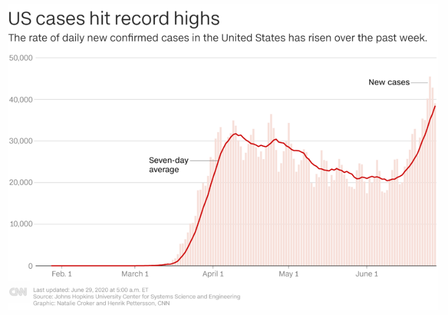

Despite all these good numbers, there are a few caution signs flashing. There are still about 8 million Americans unemployed relative to where we were in February 2020 before the pandemic hit and about 3.9 million fewer people in the labor force. These folks that are out of the labor force are people that essentially lost their jobs during the pandemic and have indicated they have ceased to continue looking for a job. As the economy continues to rebound, it will be important to note whether these folks attempt to return to the labor market. In addition, it is not clear that we will be able to get the 8 million people still seeking jobs employment. The pandemic did a lot to change the way we work. Businesses have learned they can survive with fewer employees. In addition, it is not clear that the jobs that are needed line up with the skills of those who are out of work, making the jobs recovery more challenging. We have seen interest rates climb rather steeply since the start of the year. This has taken a little bit of wind out of stocks’ sails and has raised fears of inflation and even higher interest rates. Before we start panicking, let me address this issue. During the pandemic, interest rates hit historical lows, largely because no one was borrowing for any reason. One of the key benchmark rates has been the interest rate on the 10-year Treasury bond – that is, a bond issued by the U.S. Government that matures in ten years. Before the start of the pandemic, the interest rate on these bonds ranged between 1.65% and 1.95% before plunging to an historical low of 0.53% in July. We are now back around the 1.65 – 1.70% range so this is not anything to either be surprised about nor alarmed at either. This is just another sign of markets returning to pre-pandemic normality. The big worry will be if this rate continues to creep up well past 2%, making bonds more attractive than stocks. The rise in interest rates and with a focus on the vaccine rollout and the economy getting back to normal, we saw a shift in investors mindset. This led to a change in investor sentiment from what many pundits described as moving from “growth” to “value”. A better way to explain the shift in investor sentiment would be to say it moved from technology and high growth to infrastructure and lower growth. When you look at the best performing stocks in the S&P 500 Index for the first quarter it is filled with energy (ExxonMobile Corp), materials (Nucor Corp) and industrials (Deere & Co.) while the worst performing stocks included a lot of information technology stocks (Apple Inc), health care (DaVita Inc.) and consumer discretionary (NIKE Inc.). This shift in sentiment both hurt and helped us during the quarter. Many of the mutual funds we hold across client accounts are very tilted towards ‘growth’ which typically means a higher allocation to technology names and the stocks that have done well through the pandemic. With the change in sentiment recently, many of these funds have stalled and lagged the broader stock market over the quarter. We have still done very well over the past year and I expect these funds to continue to perform well providing they continue to find sectors that are growing. We did make one change right at quarter-end, paring back dramatically on the Putnam Growth Opportunities fund (POGAX) in many client accounts. The accounts we trimmed also held the Janus Henderson Balanced Fund (JABAX) as our “core” holding. As it turns out, the Putnam fund and the Janus fund duplicated each other across most of their top holdings. This exposed us to too much risk especially in the tech sector. We chose to cut the allocation to the Putnam fund in half, which dramatically lowers the risk we are taking in client accounts. Please note that I am not saying that either fund was “bad”, just that having both funds in the same account meant we were too exposed to some stocks. The other mutual funds we hold continue to do well and we will continue to monitor them and make changes as appropriate. We benefitted from the shift in sentiment through many of our individual equity holdings. Most of the individual stocks we own are in far less glamorous industries. We do have a reasonably large bet on the housing market given our exposure to Tri Pointe Homes (ticker: TPH), Lennar Corp (ticker: LEN) and Beazer Homes USA Inc (ticker: BZH) which we added this past quarter. Other new purchases we made this quarter were also in rather mundane industries. We added Primoris Services Corp. (ticker: PRIM) which is involved in building and maintaining pipelines, gas, water and sewer systems for cities and infrastructure construction. Another new purchase for the quarter was Atlas Air Worldwide Holdings (ticker: AAWW) which buys and leases aircraft for everything from charter flights for tours to freight forwarders and e-commerce retailers (think Amazon here). The key question at the end of a quarter is always “what comes next?”. At the risk of being redundant, I am still cautiously optimistic. I know I say this seemingly every single quarter, but it remains true. I believe many of the more popular stocks are overvalued, but I also think we are still in a TINA world – there is no alternative. Much of the stimulus money from last year already found its way into the markets and I suspect much of the recent $1.9 trillion stimulus package will soon find its way into stocks. I remain convinced the market is essentially in a “liquidity bubble”. The only reason for the current stock market valuation is the extreme amount of liquidity due to stimulus money and the Federal Reserve. The Federal Reserve is contributing to this bubble by purchasing $120 billion worth of bonds every month. I am convinced this will continue as long as the Fed continues down its current path. We have already seen a couple of attempts in past years by the Federal Reserve to either cut back on buying bonds or to raise interest rates. The first attempt to cut back on the bond buying in 2013 did not end well. When the Federal Reserve finally stopped the program in October 2014, the market largely ignored the event. Many pundits compare ending this bond buying program, officially referred to as “quantitative easing” or QE, as taking away the punch bowl in the middle of the party. The most recent round of QE was begun in September 2019 and ramped up in March 2020 in response to the COVID pandemic. The only time interest rate hikes have not gone over well was when current Fed Chair Jerome Powell raised interest rates for the fourth time in December 2018 and indicated he expected two or three more hikes in 2019 which was not what the markets wanted to hear. After markets fell precipitously, Chairman Powell quickly reversed course. With this background, I would not anticipate Fed Chair Powell stopping the bond buying or raising interest rates at any point before 2022 at the earliest. In some recent testimony before Congress, he has gone so far as to indicate he is unlikely to do anything until 2023 based on his current projections. Frankly, the artificial inflation of our economy is not sustainable. As much as I understand the underlying principles involved, the diehard Keynesian in me says that enough is enough and as we get back to normal, we need to run balanced budgets and pay off debts. How this situation ends remains to be seen but that is likely some time down the road. For the short to intermediate term, our best course is to stay focused and not panic when we have small market corrections. For just over the past decade, the best course of action has been to “buy the dips” and until mindsets change in Washington, this will continue. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com This year has certainly been one for the books. I think that many of us will be glad to see 2020 in our rearview mirror. I looked back at my quarterly letters starting with last January’s letter. At that time, I was ‘cautiously optimistic’ but for all the wrong reasons. By March, I was justifiably worried and repositioning client accounts. In June, I was noting the rapid recovery at least at the top and the speculative excesses taking place in the market. By September, the markets were back to normal, but we were on the verge of another big surge in coronavirus cases and I was worried about another nationwide lockdown. So far, a nationwide lockdown seems to be off the table, but things continue to get worse. Many hospital systems across the nation are reaching critical capacity with COVID patients. The coronavirus that dominated our headlines has been unrelenting. According to the latest numbers from Johns Hopkins, as I write this note on January 3, there have been 20,451,310 confirmed cases in the U.S. and 350,357 deaths. This means that 1.71% of everyone that contracts COVID will die. By comparison, for the 2018-19 flu season, the death rate was estimated to be 34,200 deaths out of 35.5 million cases or 0.10% mortality.

When the coronavirus exploded on the scene in March, the Federal government embarked on an ambitious plan to develop a vaccine very quickly. Prior vaccines used a weakened or inactivated germ to create an immune response. However, developing that vaccine often took years. Now, using relatively recent technology called messenger RNA or mRNA, a vaccine – actually three different vaccines – has been developed and put through rigorous trials and shown to be 95% effective in a matter of months not years. The rollout of these vaccines is beginning now with front-line healthcare workers and those most vulnerable to the disease starting to receive the first of the two doses of the vaccines. Despite a year of heartache and death, the markets were relentlessly focused on the future, not the present. We saw the S&P 500 Index hit 20 new record closes this year, closing the year on the last one. The index went from 3,397.16 on August 21 to 3,508.01 on August 28, blowing through the entire 3,400 level in one week. For the year, the S&P 500 Index gained 16.26% which is quite a performance. However, if you will recall my second quarter email, I warned about not equating the S&P 500 Index with “the market”. I pointed out the difference between the S&P 500 Index everyone is familiar with and the equal-weight version of the index. To review, one of the key reasons for the difference in performance between the two indexes is how these securities are “weighted” in the index. In the equal-weight index, as the name implies, each stock starts out at 0.20% of the total account. This is rebalanced on a periodic basis to bring this back into line. The more popular version of the index uses the market capitalization which is the number of shares of the stock that are outstanding multiplied by the price per share. As a stock’s price increases, so does the market capitalization (or market cap for short). I noted the market-cap weighted index had recovered almost all their losses by the end of June while the equal weight index was still down by 12% at that point. It is a bit instructive to return to these two slightly different indexes again. While the S&P 500 Index was back to new all-time highs by mid-August, the equal-weight version – the one that is more influenced by smaller and mid-sized stocks – did not hit new highs until mid-November. The equal-weight index only hit nine new highs for the year, half of the number of the market-cap weighted index. The equal-weight version was up a respectable 10.42% for the year but this significantly lagged the market-cap weighted version. Where does this leave us at now and where are we heading? Stock prices are still at relatively elevated levels. There are many brokers and investment advisors that will try to bend and manipulate the data to justify the high current prices and valuations. I believe the reasons for the current bull market are twofold – FOMO and TINA. Let me explain. The first acronym, FOMO, is short for ‘fear of missing out’. This is the greed factor that drives investors to take greater risk, especially when they are following a crowd. This prompts investors to put money into the markets often in the wrong places as they try for that “get rich quick” idea. This can often lead to speculative excesses. Two good examples of this are Robinhood and Tesla. Robinhood is a financial app that is extremely popular nowadays. It offers access to trade stocks at no cost. Because of the way Robinhood presents itself, it makes investing very “game-like” with confetti and emojis to entice younger investors. This has led to a lot of devastating results with novice investors getting in well over their heads and pouring good money after bad. From an article in the Denver Post it was pointed out that Robinhood traders bought and sold 40 times as many shares of stock and 88 times as many option contracts as their peers at Charles Schwab or E-Trade. Robinhood saw 3 million new users sign up in 2020 and was the fourth most downloaded app on the Apple platform and the seventh most downloaded app on Android phones. With many people working from home or out of work, the 13 million total users had a lot more time on their hands to trade stocks and options on the app. And trade, they did. The revenue Robinhood earned in the second quarter of 2020 – their revenue is driven by the company getting paid based on the number of orders generated by individuals trading – eclipsed all Robinhood revenue earned between 2015 and 2018. Tesla, as you are probably aware, makes electric cars or EVs (short for electric vehicles). Tesla has been on the leading edge of the EV market and its founder and CEO, Elon Musk is either a genius or crazy, depending upon whom you ask. Tesla, the company is finally starting to do well, having turned a profit in each of its last four quarters. This led to the stock being added to the S&P 500 Index in mid-December, entering as the sixth largest company in the index. While the company is making strides, the stock has been on fire. The stock price moved from a split-adjusted price of $83.67 per share at 2019 year-end to close just over $700 per share at 2020 year-end for a 743% gain for the year. The total market value of Tesla’s stock is more than the next eight largest car companies in the world! Never mind that Tesla only has just over 1% of the total vehicle sales in the U.S. Yes, it can be argued that Tesla’s 54% of the EV market is worth some premium, but the other car companies are not sitting still and their EV sales will eventually cut into Tesla’s sales and market share. Investors seem to be assuming infinite growth forever for Tesla. The bottom line is that Tesla is probably a speculative bubble but remains popular with individual investors because it just continues to increase in price. For now. FOMO explains much of the speculative excess lately but what is TINA and how does that affect us? TINA is short for “there is no alternative. In a nutshell, with interest rates near historic lows, if investors want any kind of return, their only alternative is to invest in the stock market. As you know, Congress passed the CARES Act back in March in the wake of the shutdown of our economy. This $1.8 trillion stimulus package was designed to soften the blow of the shutdown and get the economy over this hurdle. In late December, another $900 stimulus bill was passed as part of a budget package. In addition, the Federal Reserve has spent nearly $6 trillion in buying bonds. All this money has to go somewhere, and the biggest beneficiary is the stock market. I know many of you are worried about the speculative excesses I outlined above. At the risk of sounding like a broken record, let me repeat what I said at this time last year. I am cautiously optimistic. The optimism arises from expectations for continued fiscal and monetary stimulus. In other words, I continue to think both the Federal Reserve and the incoming Biden administration will attempt to stimulate growth in the economy and get people back to work through additional spending packages. This may come in the form of more “free money” or it could come in more responsible ways. Ideally, we could finally see spending on our infrastructure – rebuilding our bridges and highway system that is crumbling. This would be a productive way to spur growth but would not be as immediate as a third stimulus check. Regardless of how stimulus comes to us, I fully expect we will see more money from the government to support the economy and to encourage and promote business and employment growth. On the cautious side of things, I want to again return to what is fast becoming my favorite metric – the ratio of the value of the stock market to the value of our economy. Just to remind you, this metric measures the value of the Wilshire 5000 stock index, the broadest measure of stock values encompassing virtually every publicly traded corporation, to the value of the output of our economy. As of the end of the third quarter 2020, which is the last measure we have available, this ratio stood at 2.01, which is a new record. In other words, the value of the stock market is currently twice the value of all of goods and services our economy produces. I asked last January when the index was much lower if this overvaluation was sustainable and answered affirmatively. I will echo that thought. As long as interest rates remain low and inflation benign, we will continue to see stock prices at these inflated levels. And speaking of interest rates…. Last January, the interest rate on a 10-year Treasury bond was just above 1.84% but that was still low relative to the 3% yield it hit in October 2018. The recent changes in interest rates have much more to do with market forces than economic issues. During the summer, interest rates hit new lows as investors were seeking the safety of bonds during the uncertainty of the pandemic. The interest rate on a 10-year Treasury bond fell to 0.54% in July before rebounding to about 1.10% today. Much of this increase in yield is due to optimism on the vaccine front and the expectation for more stimulus financed by bond sales. As investors have gotten more optimistic about the economy returning to normal, they have sold bonds and bought stocks. When investors sell bonds, the price of the bond falls which increases the interest rate yield. This is because the interest rate paid on a bond is fixed so the lower the price, the higher the yield you will earn and vice versa. The interest rate situation is one that I am paying particularly close attention to these days. This is largely because we have a couple of investments that are a bit interest rate sensitive. The two are TRI Point Group, Inc. (ticker: TPH) and Lennar Corp. (ticker: LEN), both of which are homebuilders. Low interest rates obviously help sales but there are other factors that I believe will continue to drive increased sales for these two companies. One key metric is the availability of new homes for sale. This inventory is currently at the lowest level since this data has been tracked. Couple that with a strong demand by buyers and this is a potential long-term winner. We added both names in the third quarter of the year. Changes to client accounts included two new names. We have added exposure to medical supplies distributor Cardinal Health (ticker: CAH) as well as sports retailer Hibbett Sports, Inc. (ticker: HIBB). In both cases, we continued to use options to gain exposure. However, our use of options seems to be diminishing as volatility – one key factor that allows us to earn great returns – is falling and this lowers our profit opportunities. You can expect to see a return to a more normal “buy a stock and hold” strategy. Of course, if the fundamentals change on something we own, we will not be shy about selling. This past quarter, we eliminated our holdings in ACCO Brands at a small loss as the company’s cash flow fell significantly, raising the risk on our investment. We also eliminated our exposure to construction company Great Lakes Dredge & Dock Co with a nice profit. We earned between 13% - 16.5% return on this investment in a matter of six months depending upon the account. This one was eliminated for falling cash flow, as well. In addition, we have continued to “roll” options we have on a few other securities such as MarineMax Inc (ticker: HZO), SpartanNash Company (ticker: SPTN) and Weis Markets, Inc. (ticker: WMK). By rolling, I mean we bought back an option we originally sold, obligating us to buy the underlying stock and selling another option that is another month down the road. This is adding to our long-term profits by adding additional cash without taking any additional risk. We continue to seek out new investment opportunities but there are not many that have caught our attention. Perhaps this speaks to the elevated nature of stock prices. The mutual funds we added in the second quarter of the year continue to perform admirably. We continue to research new ideas as they come along, and we encourage you to bring ideas to us as they occur. We know we do not have a corner on investment ideas. We are always willing to look at new ideas you may come across. While we are always open to short-term trade ideas, we much prefer to find good, long-term investments. Boring companies that continue to mint money for us allow us to rest easy at night. I hope this is the last time I have to say this, but I will again not be traveling to see clients this quarter. With the vaccines now available, I am just awaiting my turn for my two shots. Once I have the vaccine, I will feel far more comfortable traveling. Just because we do not all have the vaccinations yet does not mean we cannot meet face-to-face. I mentioned last quarter that I have added GoToMeeting, a video conferencing software, to my repertoire. If you would like to schedule a meeting with me, please feel free to either email me or call me and I will set this up and send you the invite to the meeting. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com This has been the longest month of March ever. Oh… wait…. It’s October now isn’t it which means another quarter has just ended. In many respects this was a normal quarter with not a lot of excitement. The market continued its relentless climb out of the depths of the recession in March peaking in early September at new all-time highs before sliding over the next three weeks in what, so far, has been a garden variety correction. Most investors consider a fall of around 10% to be a correction. The broad S&P 500 index fell 9.6% between September 2 at its peak and September 23 when it hit its lowest point.