|

For the past two years, I have been preaching to “listen to the Fed”. The Federal Reserve, the governmental agency tasked with “maximum employment and price stability”, has been steadily raising interest rates over the past two years. They last raised interest rates in July and then went on an expected pause to see how policy affected the high inflation rate they were attacking. Surprisingly, even as interest rates rose dramatically, the pace of companies hiring slowed only marginally and has remained over 200,000 new jobs per month through the November jobs report. This was in stark contrast to the widespread expectation for a recession following the dramatic interest rate hikes.

The big story of this past quarter occurred in mid-December at the last Fed meeting of the year. As was widely expected, the Fed held interest rates unchanged. However, the two big surprises came from the notes to their two-day meeting and Jay Powell’s press conference at the end of the meeting. In the notes, the Fed governors indicated they expected up to three interest rate cuts in 2024 which was a shock. Many investors had assumed one or maybe two interest rate cuts with those coming later in the year. I was in that camp, as the Fed has been consistently saying “higher for longer” meaning they want to keep interest rates at higher levels until the inflation rate returns to their 2% target range. In a bigger surprise – at least to me – Jay Powell stated in the press conference in response to a question about the timing of the rate cuts that he would expect to cut rates before inflation hits the 2% rate in order to not overshoot the target. With inflation currently around the 3.1% level, this opens up the possibility of a first rate cut in the first half of the year. With the probability of interest rate cuts on the horizon, this means a shift in investing. As interest rates fall, small and midsized companies should do better. Also, more growth-oriented companies such as tech companies should do better as interest rates fall. Given this Fed pivot, you can expect some changes to our investment lineup. Some of the changes are already in place while others will be coming soon. We have been watching a number of smaller and mid-sized companies as solid investment opportunities, but many of these stocks have seen a large run-up in price in recent weeks leading to them being “over bought” for now. We would expect prices to correct a bit, as they have been doing in the past few days, giving us a better buying opportunity. In addition to adding more smaller and mid-sized companies to client portfolios, we will be moving to more growth-oriented mutual funds for clients as well as adjusting our fixed income (bond) holdings to take advantage of the potential rate cuts to come. In finance-speak, we are going to extend the duration of our fixed income holdings. To explain that in plain English, we will be selling bond funds that focus on short-term bonds and adding funds that hold bonds that mature further out in time. This will take advantage of locking in these higher interest rates, and we should see some gains in value as interest rates fall, which will increase the value of the bonds in these funds. This past quarter, we made a few trades. We bought a U.S. Treasury note when interest rates were very near their peak, locking in a 5.2% yield through the August 2025 maturity. We also started adding a few selective smaller and mid-sized companies to client portfolios. One company that we picked up at a very reasonable valuation is egg producer Cal Maine Foods Inc. (ticker: CALM) which is already up 14% for us. Another small but growing company we added is Wabash National Corp. (ticker: WNC) which builds semi-trailers, truck bodies (think of box trucks) and processing equipment. This is a classic industrial company that is in very good shape and growing at a nice rate. Just before year-end we added a new bond fund to client accounts. We added the Janus Henderson Mortgage-Backed Securities ETF (ticker: JMBS) across most client accounts. This fund invests in mortgage bonds and, more specifically, mortgages that are backed by governmental agencies such as Federal National Mortgage Association (“Fannie Mae”) or the Government National Mortgage Association (“Ginnie Mae”). This government backing provides a level of stability to the bond holdings in the fund. Another new investment is the Putnam BDC Income ETF (ticker: PBDC), which invests in business development companies (BDCs). These are investment companies that primarily make loans to small but growing businesses that are not large enough to go public yet and need capital to grow. Sometimes, these BDCs will also take an equity stake in these businesses. These investments are a bit riskier, but often provide higher returns to investors. On the flip side, we sold our investment in online file storage company Dropbox Inc. (ticker: DBX) for a little more than a 15% gain in five months. We also sold out of Expedia Group Inc. (ticker: EXPE) – too soon it seems – for a small 3% gain. The financials seemed to be deteriorating so we chose to seek investments with a better margin of safety. Another sale was the SPDR S&P Oil & Gas Exploration & Production ETF (ticker: XOP). This had been doing well, but oil prices have been falling steadily since their late-September peak. We managed to book about an 8% gain on this fund. We also eliminated our holding in the WisdomTree Floating Rate Treasury ETF (ticker: USFR) as this was part of our shift from funds that focus on short-term bonds to ones that focus on longer-term bonds. Overall, we had a productive quarter and a very productive year. Client account returns were very good across the board. While I am very pleased, I am working to improve client performance without taking additional risk. By selectively using some option strategies, we should be able to continue to enhance client returns over time. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com

0 Comments

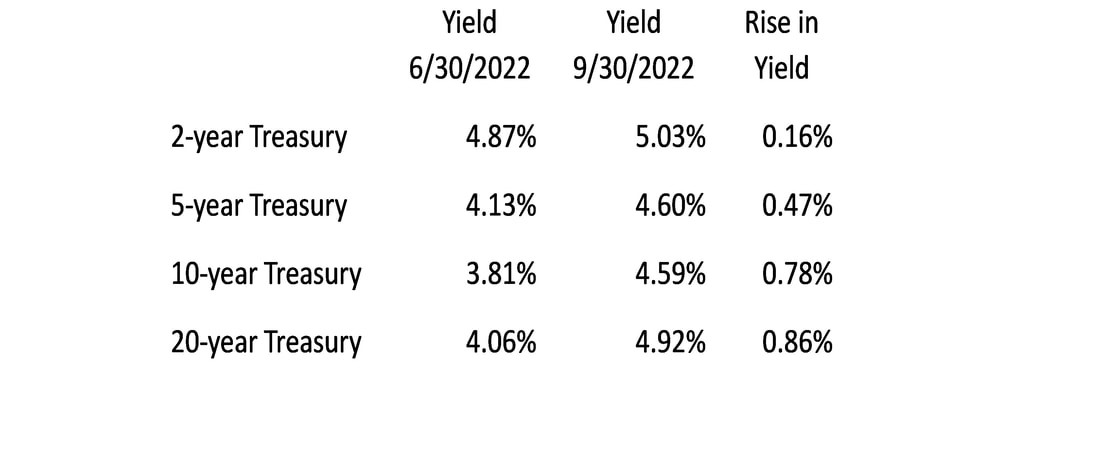

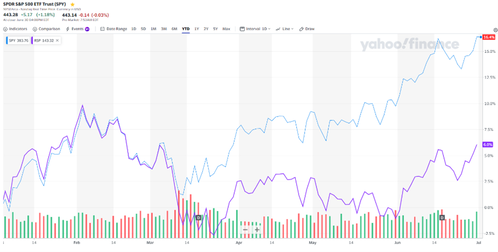

This seems to have been the quarter when investors finally started to believe what the Federal Reserve has been saying for the past year and a half. Ever since the Fed started raising interest rates in early 2022, the mantra has been “raise interest rates to the target goal to choke off inflation and keep rates at that level until the goal is met.” That clearly stated goal didn’t prevent many market pundits from predicting interest rate cuts as early as the fourth quarter of this year. What caused the shift in perspective? Simply put, economic data continued to be relatively strong. The continued solid economic numbers – from job growth to wages modestly increasing – have served to keep the pressure on the Federal Reserve in their inflation battle. While the inflation rate has dropped significantly from 9.06% in June 2022 to around 3.67% as of August, we are still not near the 2% target rate the Federal Reserve has set. As investors reassessed the big economic picture, we saw interest rates – especially longer-term interest rates – rise relatively dramatically, which caused stock prices to drop for the quarter. As you can see by the table below, interest rates moved up across the spectrum. In fact, with interest rates on Treasury bonds at highs we have not seen since 2006, we are actively looking at a few bond ideas for clients to lock in some of these higher rates. If our thesis is correct – that interest rates will remain at these elevated levels for at least the next year before we start to see any cuts in interest rates, we can earn 5 – 5.5% in interest and we may be able to see some capital gains from any individual bond or bond mutual funds we hold. These higher interest rates led to lower stock prices. The S&P 500 Index – heavily influenced by seven very large tech companies that were viewed as “safe havens” for institutional investors – fell 3.65% for the quarter. A better measure of how stocks in general fared is the equal-weight version of this index, which fell 5.45% for the quarter. The reason stock prices fell is that when investors have a choice between a higher, safer return (bonds) versus a potentially high but riskier return (stocks), they will usually choose the more certain investment option. In the current environment, when investors see a relatively sure 5% return from Treasury bonds or 6 – 8% potential return from riskier stocks with a lot more volatility, the safer return becomes the more attractive option. While stocks in general fell, not all sectors did poorly. The energy sector (oil and gas) did very well, with the S&P 500 energy sector gaining just over 12% for the quarter. The exchange-traded fund we hold across multiple client accounts, the SPDR Oil & Gas Exploration & Production ETF (ticker: XOP) gained 15.49% for the quarter. This resulted from oil rising from $70 per barrel to around $90 per barrel at the end of the quarter. Oil has pulled back a bit in price since the end of the quarter, but we continue to believe the long-term trend is for oil to remain in this price range. In part we were not very active traders this past quarter, adding only one new position in travel website company Expedia Group Inc. (ticker: EXPE). While the stock is down from our original purchase price, we still feel the company is very undervalued. We also added to our position in the VanEck Morningstar Wide Moat ETF (ticker: MOAT) several times as the price pulled back throughout the quarter. This mutual fund has been one of the best performing funds investing across large capitalization companies. This fund is now about 10% of a typical client account allocation so we are satisfied with that level of investment. Our outlook for the year ahead is the same as it always has been – believe the Federal Reserve. They have stated their intentions very clearly, and they have followed through on them. Interest rates are likely to remain around the current levels for the next few months. My one fear is that the Fed becomes too laser-focused on a 2% inflation rate. Our economy faces some structural changes – the baby boomers are retiring in droves and there are not enough workers behind them to take their places – so targeting a 2% inflation rate as we had over the past decade may not be realistic. Targeting a range of 2% - 3% inflation is probably more feasible and sustainable, but we will have to see how things evolve. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com  So far, this year is unfolding in much the way that I thought it might from an economic standpoint. However, from an investment standpoint, I admit to being confused. Investors are seemingly making some irrational decisions considering where the economy stands. Let’s review a bit. The Fed continued to raise interest rates, but just as I predicted, they only raised once during the quarter and only by one-quarter of a percent. This put the effective Fed funds interest rate at 5.125%, which was higher than the current rate of inflation. Speaking of inflation, this continued to trend down, having fallen from its high just over 9% last June to the current reading of 4.05% as of the beginning of June. We won’t have the read on the June level of inflation until early July. However, it is widely expected to remain around that 4% level. Fed Chairman Jay Powell has been adamant that he wants to bring the inflation rate back down to around 2% annually and has suggested that more rate hikes may be needed to achieve this goal. This likely means two more rate hikes this year of probably 0.25% each if the Federal Reserve goes through with this plan. The key reason Fed Chair Powell as well as other Federal Reserve Board members have intimated more rate hikes is the resiliency within the economy. Unemployment remains low at around 3.7% though the number of individuals filing for unemployment claims has ticked up a little bit in the past two months. Lower unemployment typically means a stronger economy and that often translates into sticky prices. In other words, if unemployment remains low, the inflation rate is likely to remain stuck around that 4% level, which is too high for the Fed. In addition, while it has been trending down, consumer spending is still reasonably strong, especially on such items as dining out and travel as well as new home purchases. From a psychological perspective, it seems that people are trying to return to living again after being sequestered for the past two years due to the pandemic. With that economic backdrop, the market has somewhat surprisingly gone on a tear this year with the S&P 500 Index up almost 16% through the end of June. This is very misleading, however. This index is comprised of 500 different companies. However, they do not all carry the same weight. They are ranked based on what is known as their market capitalization – that is, the number of shares of stock outstanding multiplied by the price per share. The higher the market capitalization (or market cap), the greater the weighting in the index. At quarter-end, Apple, for example, with a market cap of just over $3 trillion (yes, with a ‘t’) accounted for about 7.6% of the index and the top ten companies accounted for just over 30% while the bottom ten companies barely made a dent at just 0.30% combined. What drove that 16% gain was largely the top eight or ten companies in the index. Apple, for example, was up nearly 50% for the year-to-date period. Many of the largest tech companies that make up the top of this index – Apple, Microsoft, NVIDIA and Meta Platforms (i.e. Facebook) – all had double digit gains with Meta more than doubling over the past six months and semiconductor chipmaker NVIDIA gaining nearly 190% on an earnings report that indicated strength in demand for their chips for artificial intelligence or AI uses. Absent these top few stocks, the rest of the market was a bit more muted. One way to see this is in the disparity between two funds that measure the same set of companies but measure them differently. This chart shows the gains for the year for the S&P 500 index (light blue) as it is measured by market cap weightings versus a fund that invests in the same companies but equal weights them (purple line). The cap weighted S&P is up 16%, of course, while the equal weight version of this index is only up about 6% for the year-to-date period. In fact, one index of mid-sized company stocks, the S&P MidCap 400 Index is up just over 8% through the end of June and the S&P Small Cap 600 Index is up just over 5% for the period. This speaks to the fact that many stocks are still lagging while investors seem to be fleeing to the safety of the largest and seemingly techiest companies during this period of market uncertainty. The strong returns we saw in the first half of the year did bring us out of the bear market we had been in. Just as a side note, by convention it is agreed that when the market drops 20% or more from a high, we are in a bear market. That remains the case until we have rebounded 20% off the lowest point. The stock market, as measured by the S&P 500 Index, hit its all-time high on January 3, 2022, at 4,796.56 which was just before the Fed started raising interest rates to combat high inflation. We entered bear market territory in mid-June 2022 and the market bottomed in mid-October. In early June of this year, we had rebounded just over 20% from that low point, meaning we are “officially” in a bull market now even though we are still 7% below the all-time peak. Confusing, isn’t it? While we lagged behind the 16% S&P 500 Index gains due to being a bit more cautious, we still saw solid results. Until recently, I was convinced we could see the economy slipping into a recession by late this year. With that in mind, I was avoiding high-flying stocks and positioning accounts a bit more conservatively to weather that storm. At this point, I am pushing off any potential recession until next year and, even then I anticipate that it will be short and shallow at worst. In fact, I am beginning to think we may avoid a recession completely. I am still paying attention to both the economic data and what the Fed is saying as I believe them when they say they want to bring inflation back into that into that 2% range. I will not apologize for being cautious and I will not be chasing after the stocks that we missed on the way up. I do think many of these names are a bit overvalued at this point. This does not mean they won’t continue to go up in price. Investors can remain irrational for a very long time. But that gets into a game of trying to guess when everyone wants to sell, and I am not good at that game. I will continue to seek out quality companies trading at reasonable valuations and buy and hold them. During the past quarter, we made a few changes to client portfolios. We eliminated the First Trust Merger Arbitrage ETF (ticker: MARB) with no significant gain or loss. We felt there were other opportunities that offered better risk / return rewards. We also sold out of shipping stock, Matson Inc. (ticker: MATX) with a loss. The company fundamentals had changed significantly for the worse, so we cut our losses and moved on. On the additions side, we added trucking company ArcBest Corp (ticker: ARCB) after selling several put options that obligate us to buy the shares at a set price. I will only sell options to buy these shares at a price that I think is fair and reasonable. Eventually, one of these options was exercised but our cost was reduced by the premium we collected. At quarter-end we already had an unrealized 14% gain on this stock. We also bought shares of cloud storage company Dropbox Inc. (ticker: DBX) which has appreciated 19% since our initial purchase. Lastly, we re-entered a position in the SPDR S&P Oil & Gas Exploration & Production ETF (ticker: XOP) around the end of April after having eliminated the position in early-January. We managed to get back into the position at a more favorable price than we sold them for originally. Lastly, for several clients we locked in a bit of these higher interest rates with a one-year CD that offered 5.2% interest. Unlike a CD that you buy through your bank, this one will change in value every day based on prevailing interest rates in the market. However, if we hold it to maturity (that is exactly our intention), we will get back our investment plus the 5.2% interest rate, so do not be alarmed by any day-to-day changes in market values. Speaking of options, we continued to use option trades strategically during the quarter. We sold put options that obligated us to buy shares of metal fabricator Mueller Industries (ticker: MLI) that have given us a 13% return on the amount we are risking. We wrote options to purchase shares of semiconductor equipment company Photronics Inc. (ticker: PLAB) on four different occasions that have earned us almost 9% in total since the end of January. Keep in mind that these types of returns are no guarantee of future results. I mentioned that I will not be chasing stocks or mutual funds that have appreciated over the past few months. While I do not expect a recession any time soon, I do expect stocks to pull back a bit from time to time. When we see such weakness, we are likely to add to positions we currently own or start new positions in stocks or funds we don’t own yet but have on our watch list. We likely won’t get in at the bottom unless we are just extremely lucky, but we will always look to pay a fair price for the company or fund we purchase. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com Another quarter down and yet more volatility and uncertainty. Markets tend to be forward-looking and anticipatory of things to come. This largely comes from FOMO – fear of missing out. No one wants to miss the boat when the market turns higher. So investors attempt to predict and make bets based on these predictions.

During the first quarter, the Fed continued to raise interest rates, raising them twice but only by one-quarter of a point in February and again in March. This left the Fed funds rate in the range of 4.75% - 5.00% at the end of March. Despite these interest rate hikes, the yields on Treasury bonds actually fell for the quarter as investors seemed to be anticipating rate cuts from the Federal Reserve and sooner rather than later. Frankly, I expect one more interest rate hike in early-May by another 0.25% leaving the Fed funds rate at 5% - 5.25%, which is where Fed Chair Jay Powell has indicated he thinks rates should be at a minimum to curb inflation. Let’s look at what investors are seeing and how this has played out in the markets. At the start of the year, the inflation rate as measured by the CPI or Consumer Price Index had fallen steadily since peaking at just over 9% in June to 6% in February. There seemed to be two narratives that gave investors hope. One was that inflation was falling rapidly and would be under control soon. This would cause the Fed to start cutting interest rates. The other narrative was that the Fed, by continuing to raise interest rates, would cause a recession and would need to cut interest rates in response. In both cases, the idea of falling interest rates plays a key role. We saw this anticipation of rate cuts being played out across both stock and bond markets. In the bond market, interest rates on Treasury notes and bonds fell during the quarter, dropping by 7% - 9% during the quarter. At the start of the year, the interest rate on 2-year Treasury notes, for example, were around 4.41% but ended the quarter at just over 4% even. The interest rate on 30-year bonds fell from just under 4% in December to 3.69% at the end of March. We can tell a lot about market psychology from the interest rates we see on bonds with different maturities and how these bond yields (interest rate) change over time. By the end of the quarter, the bond market was anticipating the Fed would cut interest rates by the end of the year. This tumble in interest rates was accompanied by a rally in the stock market, especially among “growth” stocks. The key reason for this is that when interest rates are low, companies that have low debt and higher cash flows see their stock prices become more valuable. We saw this play out as the S&P 500 Index rallied 7.46% for the quarter while the tech-heavy NASDAQ 100 Index gained a whopping 16.77% for the quarter. Volatility in the stock market was relatively muted until mid-March when we suddenly encountered a banking crisis. Actually, that should be banking “crisis”. There was really only one bank in crisis that did lead to a second bank that failed but the idea that we have systemic problem is ludicrous. I will come back to this in a bit. Where do we stand in this current environment? I have been adamant that I believe what Fed Chair Jay Powell has been saying all along. We are going to see at least one more rate hike and then likely a pause to give the markets a chance to catch up to their policies. Barring some major exogenous event, I do not see the Fed cutting interest rates this year. I believe we won’t see interest rate cuts until at least the end of the first quarter of next year. I don’t see inflation falling to the 2% target very quickly, especially given the issues in the labor market. In a nutshell, the Federal Reserve is extremely worried about this current inflationary environment being a repeat of the late-1970’s era inflation. That was a time when we had wage and price spirals going. Wages for workers would go up, which caused companies to have to raise prices, which caused a new demand for higher wages which led to higher prices and the circle seemed endless. What broke that cycle was when the Fed under then chair Paul Volker dramatically raised interest rates (anyone remember 15% CD’s and 18% mortgages?) which ultimately stopped this cycle and brought inflation back down to a more normal 3% - 4% range. The current Fed is laser-focused on this very scenario. My fear is that they are misinterpreting the situation. This labor market is not like the one in the 1970’s for many reasons. The biggest reason is that that labor market had a larger supply of people to tap into than we do now. Everyone that entered the work force at that point is either retired or retiring and we just do not have enough people to replace them. This lack of supply of workers will keep wages high but I believe businesses will be limited in how much they can raise prices when most of their consumers are retired and on fixed incomes. Since the likelihood is that interest rates are going to stay higher for longer, this means the stock market is likely overvaluing stocks. I think we will see stock prices fall but I do not see a significant meltdown. I have been saying for the past year that we are in a broad range on the S&P 500 Index between 3,600 and 4,100 and that still seems to be accurate. At the end of the quarter, the index stood just over the 4,100 level which lines up with my thesis. So far. I don’t get too excited when the market hits that 4,000 – 4,100 level and I don’t panic if we fall to the 3,700 – 3,800 level. The one fly in the ointment that could change the speed at which inflation comes in is the banking “crisis”. Let me clarify what happened here. There was a bank – Silicon Valley Bank – that had been growing tremendously, focusing on tech start-up companies in Silicon Valley in California. The bank’s assets had essentially tripled in size in the past three years, with most of the deposits being corporations rather than individuals. Banks will typically invest their excess funds into reasonably safe investments such as government bonds. This bank, during the pandemic, bought 30-year Treasury bonds which are one of the safest investments around. At the time these were purchased, interest rates were still near zero so these bonds, paying about 3% interest, seemed reasonable. Then, in 2022, the Fed started raising interest rates. A basic principle in finance is that bond prices and interest rates are inversely related. That is, if interest rates go up, the price you can sell a bond you hold will fall. Conversely, if interest rates fall, the price you could sell a bond you hold will increase. With interest rates rising these 30-year Treasury bonds that Silicon Valley Bank held tumbled by as much as 20% in value. These were the worst investments they could have held in a rising interest rate environment. At the same time as their portfolio of bonds was falling, many of their depositors were looking to move their money to other banks offering to pay more interest. This caused a “run” on the bank meaning the bank did not have enough liquidity to pay out all the depositors wanting their money. This happened over a weekend in early March. The Sunday night after Silicon Valley Bank was essentially declared insolvent, I happened to turn on my TV and it was on the business network CNBC at the time. They had a “special report” entitled “BANKING CRISIS IN AMERICA” and I thought “what are they talking about?”. There was one other bank – Signature Bank in New York – that also got caught up in this “crisis”, but in fairness this bank was very involved with cryptocurrency which provided additional risks. Much of this “crisis” is in the fervent minds of the media who need headlines. Because of the failure of Silicon Valley Bank, there are likely to be additional regulations that may limit some lending by these regional banks. The outcome of these new banking regulations will have a similar effect to additional interest rate hikes which may help curb inflation sooner. However, I still do not think we are going to see a 2% inflation rate this year and the Fed has been very clear on their goal. With all of this as background, how are we positioning clients for this current environment? We made minimal changes this quarter. We are still focusing on “value” versus “growth” as we continue to believe the market is misreading the signals. We have made a very slight modification to our screen, adding a filter for very high free cash flow to find great companies worth investing in for the long term. We remain focused on solid companies that continue to grow sales at a reasonable rate and have strong free cash flows they can use to either reinvest into the company, pay dividends, buy back stock or all the above. We only made two changes of significance during the quarter. We eliminated our holdings in the Invesco DB US Dollar Index Bullish fund (ticker: UUP). This fund took advantage of the U.S. dollar being stronger than other currencies which was a result of the rising interest rates. With that coming to an end and with other countries now raising their interest rates, this fund had run its course, so we sold our entire position. The other big change we made this quarter was to make a switch in our core balanced mutual fund. Previously we had been using the Janus Henderson Balanced fund (ticker: JABAX) which is a very good fund. However, the only reason we used that one was that our all-time favorite balanced fund, the T. Rowe Price Capital Appreciation fund (ticker: PRWCX) had been closed to new investors. In late February, Capital Appreciation began a limited re-opening and we jumped at the chance to move everyone over from the Janus Henderson fund to the TROW fund. This fund – what we refer to as a 50% - 70% allocation fund, meaning it will be at least 50% invested in stocks and up to 70% invested in stocks with the balance in cash and fixed income – is the best performing fund of its kind over the past 3-, 5-, and 10-year periods. As long as the current manager remains at the helm, this will be our “go to” core fund. Aside from this core fund, one of our largest investments across client accounts continues to be the Janus Henderson AAA CLO fund (ticker: JAAA). This fund invests in portfolios of senior secured loans with floating interest rates. At present, this fund is yielding about 5.6% but this is expected to climb to around 6% next month when the interest on the loans in the portfolio are adjusted. This started out as a place for us to “park cash” and was one of the few investments that was profitable last year. This fund continues to do well for us, gaining about 1.39% for the first quarter. I have mentioned in the past that as interest rates peaked, we wanted to find places to “lock in” higher yields. However, it does not appear that we can do much better than we can in this fund. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com

We have finally come to the end of a tough year. This was a year in which there were few, if any, places to hide from the carnage. Stocks tumbled as much as 25% before bouncing in the fourth quarter to end down 19.4% for the year. Normally bonds provide at least a cushion to soften the blow, but the numerous hikes in interest rates by the Federal Reserve meant that, while bond yields (the interest rate you can earn on a bond over its life) rose dramatically, the price of bonds fell dramatically. This means if you held a bond mutual fund at the start of the year, it likely fell around 12.9% for the year. And the operative watchword for the year was “inflation”. The inflation rate peaked at 9.06% in June before starting to slowly retreat. However, by the end of November, it was still at 7.11% - well above the 2% - 3% range the Federal Reserve is targeting. This has led the Fed to hike interest rates from a range of 0% - 0.25% at the start of the year to 4.25% - 4.50% by December. We are likely to see a couple of additional rate hikes in 2023 with the expectation being a Fed funds rate of around 5% before interest rate hikes pause. Inflation is expected to continue to trend down over the next year, but we are not likely to be back at the Fed’s stated goal of 2 – 3% soon. This will mean that interest rates will be “higher for longer”. In other words, welcome to the 2000’s. Interest rates on Treasury bonds are essentially back to the levels prior to the Great Recession. The International Monetary Fund (IMF) has estimated that global inflation will decline to around 6.5% for 2023 and to 4.1% by 2024. This argues that interest rates are going to stay elevated through all of 2023 and well into 2024 before there is any chance for relief. I fully expect the Fed to hike interest rates at their next meeting at the end of January with possibly the last raise coming in March. If that happens, you will see us start to gradually shift our current bond fund mix from funds that are focused on very short-term, interest rate sensitive bond funds to ones that can “lock in” those higher interest rates for the long term. In addition to higher interest rates, which are typically a drag on stock returns, we are beginning to see companies laying off workers. The majority of these layoffs are in the companies that were beneficiaries of the pandemic and the “work from home” trends of the past two years such as DoorDash, Amazon and Peloton. While some of the numbers sound scary, we need to keep things in perspective. News media will try to spin things to sound sensational. Amazon is laying off 18,000 workers. This is only about 1.1% of their total workforce, though. DoorDash is laying off 6% of their workforce which totals about 500 people. Facebook parent Meta is laying off 13% of their workforce or about 9,300 people which is about half of the number they hired during 2021. These layoffs are certainly something to take note of when it comes to business and the economy. Many companies overstaffed in the face of boom times during and just after the pandemic. As I write this letter, the December jobs report has just been released showing continued strength in our economy. The unemployment rate ticked down slightly to around 3.5% while wages ticked up 0.3% for December. Wage inflation is a problem that can throw a monkey wrench in what the Fed is trying to accomplish. In addition, there are still about 10.5 million job openings in the U.S. currently. Many of the people being laid off from these companies will be able to find other work, though it may not necessarily be at the same pay scale or in the same field. And there will be some skill mismatch – engineers not wanting to move to retail sales, for example – but all indications are that the Federal Reserve is going to be able to engineer what economists call a “soft landing”. What the Fed wants is for the economy to slow down to rein in inflation. This is usually caused by a recession. In a “soft landing” situation, the economy manages to avoid a deep or long recession. I would submit that, given the labor shortage we currently are experiencing, any recession we have will not be your father’s recession. Unemployment is not likely to rise much above the 4% range – well below the 6% - 8% range for most of the past recessions. So what worked this past year and what did not work? The one thing that did work was oil and gas. Between inflation, a relative return to a normal world and the Russian invasion of Ukraine, oil spiked from around $75 per barrel at the start of the year to as much as $120 per barrel by June before returning at year-end to about where it started. Oil stocks were all the rage. In fact, if you look at the best performing stocks in the S&P 500 Index for the year, oil stocks were nine of the top ten and 14 of the top 17 performing stocks before you start to get to a more diversified list of companies. Very little else worked as the only other sector to have a positive return for the year were the utility companies and only by DA1.65% for the year. The three sectors that were off the most were communication services (Google parent company Alphabet, Facebook parent company Meta, Disney and Netflix, for example) which was down almost 41% for the year, consumer cyclical stocks such as Amazon, car dealers and travel and leisure companies with this sector off about 35% and technology stocks which tumbled 31.55% for the year. All of these sectors and most of these stocks fell into what advisors often call “growth” stocks. Growth stocks benefit when interest rates are low. The fact that these sectors fell as much as they did should not be a surprise in light of the interest rate situation. We managed to avoid individual stocks in these sectors during the year. The only exposure we had was through some of the mutual funds we held. We did cut most of our holdings in these funds throughout the year, but our one regret was not eliminating them all earlier in the year. More important than what did or didn’t work this past year is what will or won’t work for the next year or two. Much depends upon how the economy shapes up, of course, but we have some clues based on history. As Mark Twain once said, “history doesn’t repeat but it often rhymes.” We have been going back through history to find time periods that were similar, though, in many ways, this time really is different. Structurally, the U.S. is in a different place now than it ever has been in history. That aside, there will be parts of the economy that “rhyme” with the past giving us clues as to what may and may not work. As for client accounts, we avoided a lot of trading in the fourth quarter. The biggest moves we made involved the reallocation of fixed income holdings. We have finally settled on four different funds to use for exposure to fixed income (bonds). With rising interest rates during the year, this has been a tough sector to find what works. The four funds we are using include two that take advantage of rising rates by investing in bonds or loans that have adjustable interest rates. As interest rates increase, the income from these bonds or loans increases, leading to higher income to us as shareholders and a bit more stable price. The two funds that benefit from rising interest rates are the Janus Henderson AAA CLO fund (ticker: JAAA) and the Wisdom Tree Floating Rate Treasury fund (ticker: USFR). Both funds ended up for the year with JAAA gaining 0.53% and USFR up 1.98% for the year. In addition to these two funds, we added two new funds to the mix. One is a nontraditional, “go anywhere” bond fund from T. Rowe Price. It is the Global Dynamic Bond fund (ticker: RPIEX) and this fund was up 3.6% for the year. The last fund we are using in our fixed income mix is not exactly what most investors would think of when it comes to “fixed income”. When it comes to investing in fixed income securities, the idea is to earn a reasonable rate of interest that compensates for the risk over the time period you are holding the investment. If you buy a three-year CD, for example, you will want to earn a higher rate of interest per year than if you bought a one-year CD. The same should hold if you bought a bond that matures in five years. You would likely ask for a higher interest rate than for the 3-year CD or bond. The fund we are using is the First Trust Vivaldi Merger Arbitrage fund (ticker: MARB). This fund invests in merger deals. These are deals where one company makes an offer to buy another company. When this happens, the price of the stock of the company being acquired will usually jump but there will still be a difference between the current stock price and the ultimate purchase price. As you get closer to the time when the deal will close, this gap narrows. Buying shares of the company to be acquired is a lower risk way to hopefully earn a fixed return. This return is usually related to prevailing interest rates rather than stock market performance. These types of investments have a low correlation to how the stock market performs and generally much less risk during down markets. In fact, this particular fund was up 3.89% for the year. The only other significant trade we made was eliminating our holding in Ingles Markets (ticker: IMKTA), a regional grocery chain. We sold out of that near the end of November for about a 57% profit in a little more than the year we held the stock. It’s not that the company was doing anything wrong, but the price was getting well above what we calculated as its fair value. If things change, we will consider re-entering the position. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com September 2022

Let’s cut right to the chase. Ouch. Tough month. Tough quarter. Tough year. We keep hearing “lowest since….” in regard to the stock market and “highest since…” regarding interest rates. Inflation has been the story of the year. We have begun to see signs that inflation may be moderating. Until it drops significantly though, we are going to see continued interest rate hikes. Just to remind you of where we are, the official measure of inflation topped out at 9.1% on an annualized basis in June. We have seen a small tick down in the inflation rate to 8.5% in July and 8.3% in August. That is still an inflation rate we have not seen since early-1982. This has been the big disconnect that is driving much of the volatility in the markets. Many traders are saying – hoping, actually – that this small tick down in the rate of inflation will cause the Federal Reserve to pause interest rate hikes. Some even go so far as to talk wistfully of the Fed “pivoting” – that is, actually cutting interest rates because they have gone too far. Every member of the Federal Reserve Board has been clear that cutting interest rates is not even on the table for discussion. At best, we can expect one or two more interest rate hikes and then a pause to see how all of this filters through the economic system. In other words, once the Fed funds rate – the interest rate that banks pay to borrow money overnight and that largely determines other interest rates in the system – gets into a range of 4% - 4.5%, we can expect the Fed to perhaps stop raising rates for some brief period. What does all this mean to us as investors? I am firmly in the camp of “listen to the Fed”. Fed Chairman Jerome Powell has been clear that inflation is their key problem, and they will not back off until the inflation rate is back down to something close to 2% on an annual basis. My personal belief is that they might be okay with an inflation rate between 2% and 3% per year, but that is still a long way off from the current 8.3% annual rate. This means we can expect interest rates to continue to rise. The current Fed funds rate is currently around 3.25% per year. I think we will see this at a 4.5% annual rate by the end of December. Higher interest rates are generally not great for stocks for several reasons. The simplest reason higher interest rates are bad for stocks in general is that investors have an easier choice. When it comes to investing, the goal is to earn a return on your investment. When interest rates were essentially zero, there was no alternative. Investors we forced to buy stocks either for their growth or their dividends or both. When investors can earn a reasonable interest rate on a bond investment, they now have choices. Do they buy a bond that pays a guaranteed interest rate of 4% or 4.5% or 5% or do they buy a stock that pays a dividend of 2% and may grow in value over the next year? With choices like that many investors, especially more risk averse investors, will sell stocks and buy bonds. This leads to stock prices falling. Another key reason for higher interest rates being bad for stocks is what we call the “discounted future value” of stocks. Pardon me if I get a little math geeky for the next paragraph or two. A share of stock represents ownership of a business and a claim on any current and future earnings of that business. We invest in businesses that we anticipate will grow over time providing more cash to investors. However, one dollar earned next year is not worth the same as one dollar today. Why? We can take the one dollar we have today and deposit it in a bank and earn interest on that dollar. The more interest we can earn, the less one dollar one year from now is worth to us today. For example, if we can earn 5% interest annually today, we could invest $100 today and end up with $105 in one year. Conversely, if we wanted $100 one year from now, we would only need to invest about $95.24 today earning 5% interest to end up with $100 in one year. This is a concept called ‘discounted cash flow’ and is the basis for how many investors value a stock today. These investors will estimate how much cash the company will generate per share into the future. They will then discount those cash flows back to today to arrive at what is known as the ‘present value’ of these future anticipated cash flows. This is where interest rates come into the picture. The higher interest rates are on safer investments like Treasury bonds, the higher the interest rate an investor will demand on a stock to make the risk worth investing. If I can earn 4% per year buying a Treasury bond which is backed by the U.S. government, I may decide that I need a 10% return to take more risk and buy a stock that may or may not continue to grow into the future. Going back to the $100 above, if I determine a company is going to return $100 in the future and I discount that at 4%, I am willing to pay $96.15 today for that stock. However, if I require an 10% return to entice me into buying a stock, I would only be willing to pay $90.91 for that stock today to have $100 in one year. Apply this same concept across all stocks. When interest rates were zero, stocks were worth just about anything you were willing to pay. As interest rates increase, the “discounted” value falls. Given this set-up, stocks are likely to fall a bit further. However, I am not expecting a dramatic tumble. I truly think the worst is behind us. In part, I believe some of the expectations for higher interest rates are already reflected in current stock prices. What is not reflected is that investors really have no idea how far interest rates will increase. I have been saying now for a while that the stock market is seemingly stuck in a range between 3,600 and 4,200 as levels of the S&P 500 Index. The index closed just below this at the end of September. I believe investors are expecting the Fed to cut interest rates by another 0.75% in November. The big question is will they also cut in December and by how much. This is what could portend some additional volatility and lower prices by the end of the year. I think this would be short-lived, though as the likelihood is that the Fed will then pause interest rate hikes to see what effect all their work has had on reducing inflation. That is part of the problem with these hikes. They take a while to filter through the economic system and affect the inflation rate. How are we dealing with this volatility given our expectations? We have already taken several steps and anticipate several more along the way. In part, we are using the volatility and lower stock prices as a good buying opportunity. We have added to a few current positions in addition to adding a few new positions and eliminating others. We added to our holdings in two mutual funds. One is the Applied Finance Explorer fund (ticker: AFDVX) which invests in smaller company stocks. We also added a little bit to our Janus Henderson Contrarian fund holdings (ticker: JSVAX) which invests in mid-sized companies. As the markets fell, we added a little bit to our holdings in Berkshire Hathaway class B shares (ticker: BRK.B) when the stock fell below $300 per share. This stock may be classified as a “financial service” company based on its insurance businesses, but it almost qualifies as what used to be known as a conglomerate that touches everything from boots to ice cream to bricks and railroads. In addition to the myriad private companies Berkshire owns, there is also an extensive stock portfolio as well making this holding a hybrid between an insurance company, a conglomerate or holding company and a mutual fund. We added several new positions this last quarter, several of which should take advantage of higher inflation and interest rates. We added two stocks of companies that are primarily fertilizer companies. We bought CF Industries (ticker: CF) and CVR Partners LP (ticker: UAN) to take advantage of elevated food prices and production. We also added two new positions to take advantage of rising oil prices. We shifted away from the oil ETF we had traded earlier in the year to a couple of individual oil company stocks. The first we added was PDC Energy (ticker: PDCE) which is an oil and gas exploration and production firm. We were starting to evaluate more oil companies as potential investment opportunities when we chose to simplify things and bought the SPDR Oil & Gas Exploration and Production ETF (ticker: XOP). This is a mutual fund that invests relatively equally across all the stocks we were looking at for this space which simplified this investment for us. While we readily acknowledge climate change is a real issue, it has become clear that we are not ready to flip a switch and turn off fossil fuels and turn on alternative energy. We need time to get there and, in the interim, oil and natural gas will continue to be viable and profitable. We also added another shipping company, Star Bulk Carriers (ticker: SBLK) to our holdings. This company should continue to profit from the continuing supply chain disruptions though revenues may fall a bit should we have a global recession. We also added two investments that will take advantage of rising interest rates. One is the Wisdom Tree Floating Rate Treasury ETF (ticker: USFR) which is a mutual fund that buys Treasury bonds with interest rates that adjust up or down based on the prevailing interest rates in the economy. This is another safe place for us to park excess cash and still earn a little bit of a return on our money. This fund has an annual dividend yield around 2.5% with dividends paid out monthly. We also added shares of the Invesco DB U.S. Dollar Bullish fund (ticker: UUP) which is a mutual fund that trades foreign currencies. When interest rates rise in the U.S., foreign investors will typically want to buy our government bonds which pay a higher interest rate then their own bonds. In order to buy our bonds, foreigners need to sell their currencies and buy U.S. dollars. This drives up the value of the U.S. dollar which is what this fund exploits. We eliminated a few positions over the quarter for various reasons. We sold out of consulting company CRA International (ticker: CRAI) with just over a 10% return. We eliminated Activision Blizzard (ticker: ATVI), which has an offer to be bought by Microsoft. The merger seems to be running into some regulatory issues, and we chose to step back, taking a small 4% loss. Should the regulatory picture become clearer, we may return to this stock. We also sold out of two companies closely tied to the homebuilding industry. We sold our shares of timber real estate company PotlatchDeltic Corp (ticker: PCH) as the price of lumber continues to fall. We also closed out homebuilder Tri Point Group (ticker: TPH) as rising interest rates make this holding more of a “value trap” than a value currently. The Tri Point Group still has value but rising interest rates will likely hamper growth for the next year or two. We figured we could always revisit this stock when we think interest rates are going to start coming back down. We are continuing to review new investment opportunities and have several new funds and individual investments that we are vetting for risk and potential returns. These challenging times mean we have to seek out creative solutions. Some of these solutions we have already implemented, such as the Wisdom Tree Floating Rate Treasury ETF. This investment is a good short-term solution to rising interest rates but once interest rates peak, we will probably shift much of that investment to bond funds that offer a higher yield. Rest assured we are doing our due diligence before committing client money to any new investment idea. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com July 2022

It would seem that everything old is new again. We are back to inflation rates that we have not seen since 1982 which caused the Federal Reserve to hike interest rates in June by 0.75% which was the largest rate increase since 1994. This has led to the worst first six months start to the stock market since 1970. In addition to high inflation, there are signs that we may technically be in a recession currently. Economists define a recession as at least two consecutive quarters of negative growth in an economy. For the first quarter of this year, our GDP or gross domestic production, which is the measure of the growth of the U.S. economy, fell at a 1.6% annualized rate. Early estimates for the second quarter, which will be released around the end of July, indicate the economy may have contracted at an annualized rate of 2.1%. If that is the case, then we are technically in a recession. If we are in a recession, this could help the Federal Reserve out with taming the current high inflation rate. There is an old maxim on Wall Street that the best cure for high prices are high prices. This makes some sense as people will tend to cut back on spending when prices jump which eventually causes prices to come back down. The expectation though, is that the Federal Reserve will continue to be aggressive in raising interest rates as their means to combat an inflation rate that is currently running around 8.6% annually. However, if inflation drops off rapidly, which it could do from the combination of higher interest rates and a recession, the Federal Reserve won’t need to raise interest rates as much as had been expected. In fact, the expectations for how far the Federal Reserve will raise their benchmark Fed funds rate has fallen from around 3.8% in early June to about 3.2% currently. There are some that even expect rate cuts in 2023, should the recession continue, and inflation be reined in. In looking at past recessions and how the Federal Reserve responded, the only period that correlates to our current environment is the mid-1970’s. The U.S. economy went into a recession in the first quarter of 1974 that lasted for about a year through the first quarter of 1975. During that period, the Fed funds rate started at around 9.75%, rose to just over 13.3% before being cut back to around 5.5% by the end of the recession. This was also the era of the oil embargo by the OPEC nations which started in October 1973 and ended in March 1974 but saw the price of a barrel of oil rise four-fold from $2.90 per barrel to $11.65 per barrel. It was this oil shock coupled with easy money and a lack of fiscal discipline, especially around spending to fund the Vietnam War that pushed the U.S. economy over the edge into a recession. While $11.65 per barrel oil seems quaint now, that would be the equivalent of oil at over $200 per barrel today. Mark Twain once said that history does not repeat itself, but it does often rhyme. This would be one of those cases. The current environment we find ourselves in has echoes of the 1970’s oil supply shock in the pandemic-induced shortage of just about everything. Add to that the easy money of zero interest rates and the three stimulus checks given out to spur the economy during and post-pandemic and we have a similar situation to the mid-1970’s. Much of the reason for the current oil supply issues revolve around oil companies dramatically cutting back on what is known as “capital spending” – the money they would spend to explore for and drill new wells or to bring old wells back on-line. The key reason oil companies are reluctant to spend that money is a long history of “boom-bust” cycles in the oil patch. It would seem the companies have finally learned their lesson not to ramp up spending just because oil prices have jumped. In addition, even if more wells were brought back on-line, there is an issue with a lack of refineries to turn the oil into gasoline. Currently, the refineries we have in the U.S. are operating at about 94% capacity. The capacity that is not being utilized is due to maintenance and repairs being done to the facilities. In fact, no new refinery has been built in the U.S. since 1977. There have been upgrades to some older refineries over the years, but we still lack a capacity to refine much more oil into gasoline. And no oil company is going to commit to a years-long project and spend over $1 billion to build another refinery of any size with the pressures of investors bearing down on them to reduce their carbon footprint and shift to renewable energy. All of this has led to a very tough investing environment. The broad stock market fell over 8% in June alone taking the market down just over 20% for the year-to-date period and putting us in what is generally regarded as a bear market. Making things more challenging is the fact that many investments that should have done well this year have not performed as expected. You would think that mutual funds that invest in bonds that take advantage of rising interest rates would be knocking the cover off the ball right now. Most are down between 1.25% and 1.5% for the year despite three interest rate hikes so far this year. Even the mutual fund that invests in TIPS – Treasury Inflation Protected Securities or bonds that automatically adjust their value to protect holders from high inflation – lost over 9% of its value for the year! This has affected our current lone bond holding, the Janus Henderson AAA CLO ETF. This mutual fund, which invests in the safest short-term loans, has seen its dividend yield increase from around 1% at the start of the year to 2% currently. However, the share price has fallen a little over 2% since the start of the year, which has dragged down performance. One of the few areas that has done well has been oil and oil stocks. While we don’t own any oil stocks (yet), we did make some money by trading in this space. We sold an option that obligated us to buy shares of Continental Development for $6 per share which we closed early, earning a 4.54% return in a month. We also obligated clients to buy shares of Occidental Petroleum at $50 per share just before news broke that Berkshire Hathaway had taken a large 7% interest in the company and the share price jumped to over $60 per share. We still earned a 3.2% return in a month on our investment. We also made some trades in the United States Oil Fund LP ETF, a fund that is tied to the price of oil using futures. Over the five-month period that we traded options in this fund, we earned between a 36% and 47% return without risking more than 1% of a client’s account. We do currently have options outstanding obligating us to buy shares of PDC Energy Inc. (ticker: PDCE), formerly Petroleum Development Corporation. We are currently obligated to buy shares at $59.50 but given the premium we have collected our cost would be about $57.80 per share. In addition, we have earned a 3.32% return from selling a previous option that expired worthless. As much as we as a country need to make a shift to clean, renewable energy, we are not ready to make that leap just yet and oil and some oil companies will continue to do well for the next few years. We did add two new funds to client accounts this quarter. We have tiptoed into the Applied Finance Explorer fund (ticker: AFDVX). We have been familiar with Applied Finance group since shortly after we started our firm. The Applied Finance Group began as a company selling research on companies to portfolio managers. They eventually branched out into managing money and then started mutual funds. The Applied Finance group has what I think is a unique approach to calculating the value of a stock. They do not use traditional “value” or “growth” metrics that most mutual fund managers box themselves into using. Instead, they look at what they call the “economic value added”. That is, does the company they are evaluating create or destroy shareholder value. They are looking for companies creating shareholder value. This sort of approach is one that appeals to me and is similar to my methodology. This fund invests in small companies. We only have a small position currently but expect us to add more shares on weakness in the markets. We sold out of the BlackRock Mid Cap Growth fund this past quarter. While we did well in that fund, notching a 40% gain while we held it, this fund was becoming too risky in the current environment. We began to move to the Janus Henderson Contrarian fund (ticker: JSVAX) for exposure to midsized company stocks. This fund marches to the beat of its own drummer. What I mean by that is the fund is happy to find value wherever it can rather than following a particular benchmark. This has proven to be successful, leading to smaller losses during tough times and better returns during good times. Again, we have just a small position so far, but expect us to continue to add to this on market pullbacks. We did eliminate three holdings from last year, selling out of Hillenbrand Inc. (ticker: HI) with a 13% loss on this stock. The company has been showing more weakness lately which prompted the sale. We also closed out our Hologic Inc. (ticker: HOLX) position for a small 2.32% gain. Our biggest success came with Sanderson Farms, Inc. (ticker: SAFM), one of the largest producers of chicken. A partnership of Cargill and Continental Grain agreed to purchase Sanderson Farms for $203 per share in cash. We originally purchased shares for around $189.70 per share at the end of December. We expected to lock in a 7% return once the deal closed later this year. However, in late-June, shares of Sanderson Farms were trading above the $203 merger price, so we sold our shares for just over $210 per share, notching an almost 12% return in six months. Likely, the market is expecting the merger deal to be modified with additional funds from private equity to get around some governmental concerns regarding too much concentration but in the absence of a definitive deal, we will take the sure thing now. In addition to the PDC Energy stock mentioned above, we have sold options against several other stocks that we want to buy. Why are we selling options rather than just buying the stocks outright? The key reason is that we are taking advantage of the increased level of volatility in the market. This increased volatility which arises from the uncertainty about what the market will do allows us to earn large premiums from selling an option that obligates us to buy the stock at a set price. If the stock falls, we end up buying the stock but at a more favorable price. If the stock doesn’t fall, we still make money from waiting – usually 2% - 3% on the amount we are setting aside for the purchase within a 30-day period. In our last quarterly letter, we suggested that, if you had excess cash that you could “lock up” for at least one year, you should look into buying a Series I Treasury bond. This can be done by going to http://treasurydirect.gov and setting up an account to have money drafted from your checking or savings account to make the purchase. You are limited to $10,000 in purchases per person per year for these bonds. When we made this suggestion back in February, the I-bonds were paying a little over 7% interest on an annualized basis. These bonds have their interest rate adjusted twice per year and a portion of the interest rate is based on the current inflation rate. If you have not taken advantage of these bonds yet, now is a good time to consider them. The current interest rate on these bonds will be about 9.62% per year. For those of you that did take advantage of them earlier, you will get this same rate, so you are not missing out on anything. Again, let me reiterate that you cannot redeem these bonds within the first year of purchase. After one year and before five years, you can redeem them, but you will lose the previous three months’ worth of interest. After five years, you can redeem them for their then current value, and they fully mature in thirty years. We will continue to update you on these bonds. We are currently holding more cash in client accounts than we normally would but much of that cash backs up many of the options we have sold. For example, we sold options that obligate us to buy shares of agricultural chemical company American Vanguard Corp. (ticker: AVD) at $20 per share. For every 100 shares that we want to purchase (each option represents 100 shares), $2,000 is set aside to make sure we can buy the shares should the stock price drop to $20 or less. In the interim, we have earned a premium of $31.25 for taking on this obligation. That may not sound like a lot but that equates to 1.56% in just 24 days. While I hope to purchase the shares, should we not have to when the option expires in mid-July, we will simply try this same strategy again. You can expect that we will gradually add more equity names – both individual stocks and additions to mutual fund holdings on weakness in the markets as we do not expect this downturn to be a long-term event. Unless we are exceedingly lucky, we won’t buy at the exact bottom, but we will generally buy at favorable prices. You can also expect us to gradually add more exposure to bonds to client accounts, especially as interest rates finally offer a more attractive return than zero percent. As always, we truly appreciate the trust you have placed in us, and the opportunity you have given us to manage a portion of your assets. If you have any questions or need to discuss any issues, please feel free to give us a call. Sincerely, Alan R. Myers, CFA President / Senior Portfolio Manager Aerie Capital Management, LLC (866) 857-4095 www.aeriecapitalmgmt.com If you go back to my last client quarterly letter, you will note that I managed to nail what we have seen so far this year. Increased volatility in the stock market? Check. A ten percent correction? Check. Higher interest rates? Check. Lower stock prices? Check. While I did not mention war, anyone who did not seriously think Russia was going to invade Ukraine was fooling themselves. In early-February, I wrote a note that was posted on our website which addressed some of these issues. In that blog post (https://www.aeriecapitalmgmt.com/blog), I tried to explain why we had more volatility this year. Let me address this briefly here. The answer started with explaining how rising interest rates affected the value of stocks.